Tesla's Complete Master Plan 3

Mar 15, 2023Price Target: Unlock

Current Price: $173

Target Date: Unlock

Stock: Tesla ($TSLA)

Well folks, it's only been a quarter since we last updated our Tesla ($TSLA) thesis and somehow even more has changed.

While $TSLA is still making solid progress towards our original price target, the market has decided to have a pretty ho-hum reaction to their most recent investor day.

This is wild for us considering that this investor day showed us SO MUCH that we needed to see in order to be more bullish on the once and future king of EVs moving forward.

It's really interesting from our perspective because in a way, Tesla is becoming a company that reflects so much of the big changes we're seeing in the global economy.

Their recent moves signal a manufacturing process that will adapt with the current reshoring climate, as well as materials updates that will slowly unplug them from potentially hostile environments.

All in all, Tesla is fighting hard to widen its competitive edge as every large automaker makes its own big shifts to the EV space.

So much of Tesla's investor day is going under-reported as the market is more focused on a lack of updates about bigger moves being made there.

Silence on the new model front is a little concerning, but completely outweighed by all the small moves Tesla is making toward increased margins and future-proofing their business.

There's a lot to cover here, so let's get into it. 👇

Tesla's HUGE Manufacturing Updates:

Before we jump into our new analysis, everything we've said over the last several years, more or less remains true today.

And to summarize, that is, we love Tesla because they are executing on: vertical integration, profitability, market dominance, and access.

We're basically going to start every analysis of TSLA with that statement because in order to continue their market domination, Tesla has to stay on top of all four of those areas.

Which is why this investor day was a big deal for us. There are two main reasons here:

-

Tesla made an INSANE update to their motors. Let's not bore you to death with details, but Tesla engineers just casually announced they have developed a new version of their motor that will not require rare-earth minerals.

-

This is a really small update but it gives Tesla a very useful advantage. EVs are so profitable because they are so much simpler to build than combustion-based vehicles. The caveat here is simple: the materials to build those cars are expensive and (kinda) scarce. With increased competition in the EV space and the Biden Admin's IRA encouraging a boatload of investment in areas that will need the same lithium, nickel, and cobalt that EVs do, the cost of building EVs is only going to go up in the next few years. That's why taking rare earths out of the equation is huge. Not needing things like palladium or neodymium for your engine is massive because, without those exorbitant costs, Tesla procurement can focus entirely on staying competitive with the big expenses like lithium and Nickel. A simple supply chain just got even simpler, especially considering the major source for a lot of these rare earth minerals is China currently.

-

-

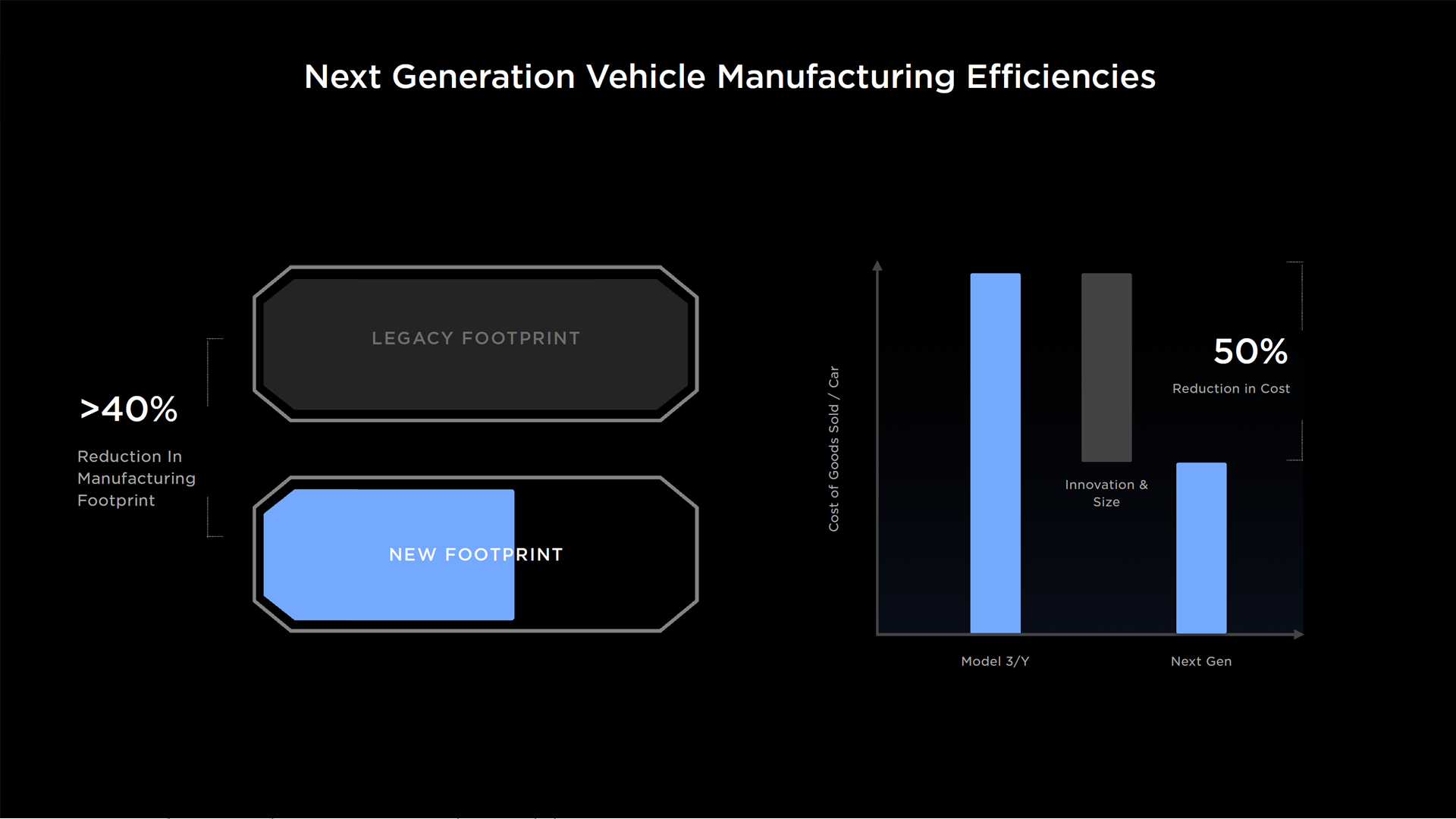

Manufacturing gets smaller, and more automated. Again, the market glossed over the fact that Tesla is developing new manufacturing processes that are both smaller and more automated. These two factors play into our reshoring narrative.

-

Tesla also announced that their next big factory will be in Monterrey, Mexico, furthering that reshoring path. Tesla is clearly future-proofing their supply chain to ensure that there are no more big disruptions like what we saw during COVID. A smaller and more automated factory opens up new possibilities for building those factories in North America and keeping production costs low enough to match reduced vehicle prices. All in all, Tesla is already behaving like a company in the 2040s, not the 20s.

-

As we move away from a more globalized economy, little updates like this from Tesla ensure their competitive advantage and continually prove the bull model we've had since the get-go.

It's frankly wild to see Tesla leadership respond to trends we've been reporting on--as you don't hear a lot about reshoring and materials costs outside our nerdy little world.

But with that, it's not just building cars better, it's building a whole better product that's making Tesla more attractive moving forward.

Not Just Cars:

Tesla has also announced solid progress on their Tesla Energy vertical.

They've managed to ship 16GW of units to over a dozen countries.

Simplicity is going to be TSLA's major win on the energy side as well.

Megapack, a new upscale energy product, is compatible with every energy grid on earth -- allowing for way simpler manufacturing and sales as they ramp up this side of the business.

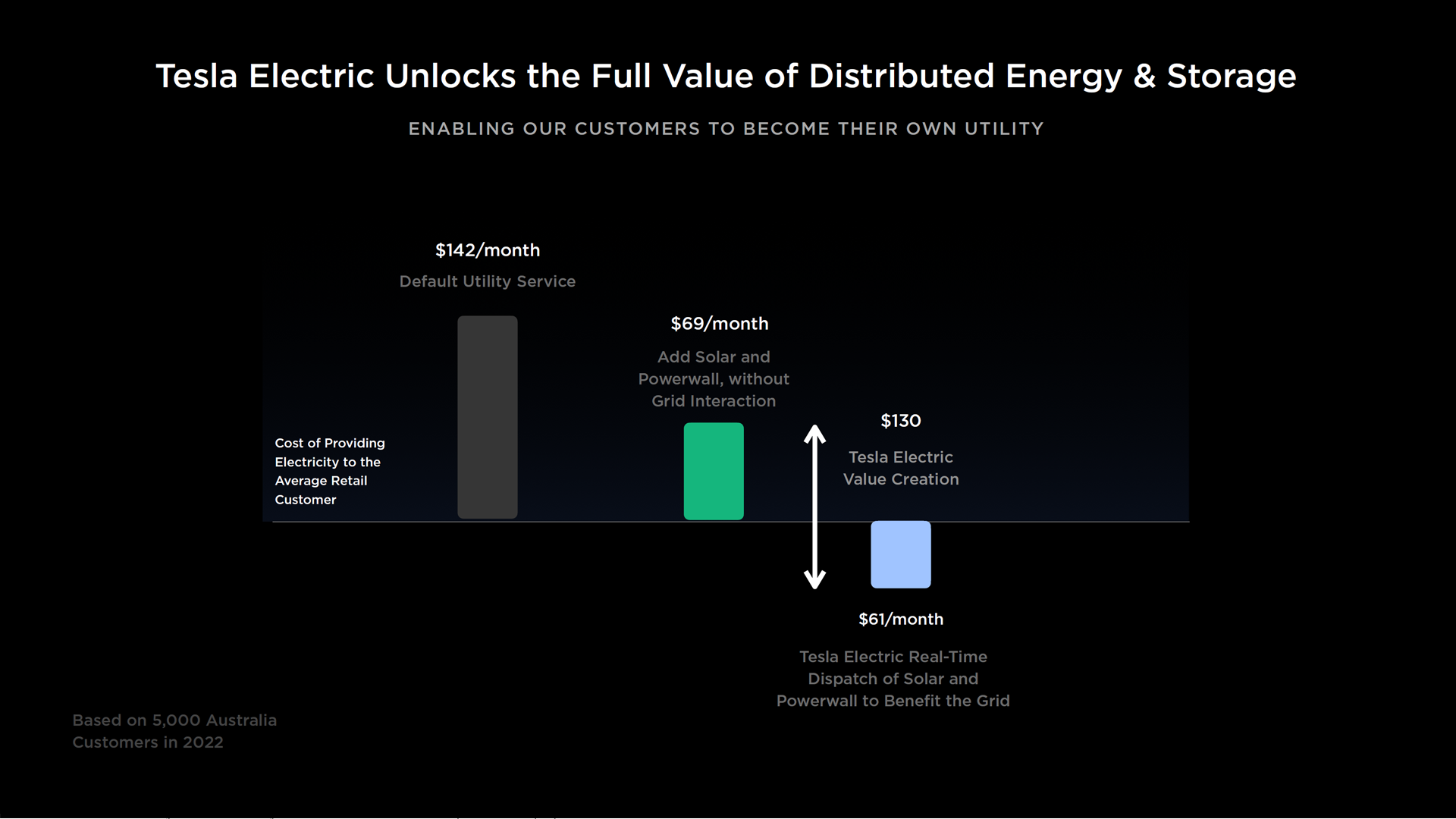

Furthermore, Tesla is also rolling out new features that will bring more customers to renewable energy, such as Tesla Electric.

Electric is Tesla's way of allowing power wall customers to sell their electricity back to the grid. This ties into Tesla's massive new plans for a fully renewable power grid.

Right now, Tesla Electric is only available in Texas and there aren't any published plans for getting it to other states.

Regardless, we like Electric as a huge indicator of how Tesla's software and manufacturing advances can allow them to build a more distributed future for renewable energy generation.

All in all, Tesla is building a solid future for their energy vertical using all the incredible learnings they've pulled off from its EV division.

Tesla Outlook:

Like a lot of the EV and renewable industry, 2023 is a major make-or-break year for Tesla.

We need to see their cost per vehicle continue to go down so they can maintain the margins in order to justify a bullish stance on the company.

Frankly, the pessimism being shown by the market is more related to distractions than fundamentals.

It's one of these key moments where TSLA is being (relatively) undervalued thanks to the unpopular antics of Elon Musk over at Twitter. We never liked Tesla because of Elon, we liked Tesla because of its solid business structure and insane margins.

Tesla's investor day made a lot of sense to us. The next major product TSLA needs to unveil is their cheaper vehicles -- which may not lend themselves to a large fanfare rollout like an investor day (save the bells and whistles for your luxury customer y'all).

But all-in-all, we're really excited to see how Tesla is iterating toward a massive new vision for how we produce and distribute energy as a society.

We're a long way from Tesla executing on that vision, but we're at least on the path to solid gains.

Risk/Reward: Medium-High / Very High

Rating: Overweight

Dividend Yield: 0%

Market Cap: $543B