The Moby Flagship Tech Portfolio

Jul 28, 2022Welcome back to this month's update of the Moby Tech Portfolio!

If you're new to this portfolio strategy, its goal is to outperform the market by investing in tech companies that are reasonably priced, while also taking on less risk! We do this by looking for companies with above-average earnings and revenue growth, but at normal valuations.

And guess what? This portfolio is up huge over the last month. So, how'd we do it?

If you've missed the "news" right now investors only care about companies that are growing responsibly. Gone are the days when growth at all costs was an actual business strategy.

Nowadays, while growth is important, you need to grow "right". So that's why we have been looking for stocks that are growing at a reasonable price.

Tech stocks might have gotten crushed over the last year but if you're looking in the right places, there are still plenty of amazing opportunities.

For a more in-depth explanation of how this strategy works, just read this post!

By following the tried and true discipline of buying good companies at reasonable prices, we can maintain our confidence in our portfolio and ride out the storm.

So with that intro, today we're going to cover:

- The portfolio's performance.

- The stocks we bought & the stocks we sold.

- And why we did it!

Performance Overview:

In another crazy month for the market, our Tech Portfolio returned 10%!

We're extremely thrilled with the performance this month. But, in full transparency, a large portion of this performance was due to markets as a whole rebounding.

When looking at the Nasdaq, this portfolio's benchmark, we see that it performed very similarly. But the reason is not what you might expect.

Without diving too much into the details, tech stocks got slaughtered because interest rates were rising and valuations were coming down. However, over the last month, the Fed signaled that they may start slowing down their interest rate increases which is great for tech stocks!

While we're not out of the woods yet, markets during these times act indiscriminately. What that means is that no matter what your fundamentals are, most of the time, if a stock's sector goes up it'll likely benefit and vice versa. While this is great in the short run, the last year has taught us that this is not great over the long run.

That's why we've seen fundamentally sound companies like Microsoft stay flat over the last 12 months, while risky tech stocks like Coinbase go down over 75%.

Long story short, while the month-to-month mirrors the performance of the benchmark, only over the longer term will these start to deviate.

And from what we've seen over the last year, our portfolio's performance has outperformed while also taking on significantly less risk.

So with that context, here's the performance of each stock in the portfolio!

Highlights:

-

Winners

-

Our old friend EPAM has come out on top again this month -- for the second month in a row. And similar to last month, off a sizable beat of Q1 earnings, EPAM has continued to sustain its positive momentum. The stock is currently down about 50% from its all-time high, mostly because of its exposure to the Russia-Ukraine conflict; however, the company has made a commitment to reduce that exposure over time. With this reduction in exposure and strong revenue growth, EPAM still has much further room to run!

-

Apple's stock has done extremely well over the last month ahead of its earnings release. Do we even need to say it? Apple is arguably the best company in the world and it should come as no surprise that when the market rebounded, Apple would rebound along with it. We'll continue to rate Apple overweight from now until eternity.

-

-

Losers

-

The only loser in the portfolio this month was Concentrix. If you're not familiar with the company they are specializing in customer engagement and business performance. Their numbers are still solid but the stock has sold off due to market pressures around their name. With the acquisition of ServiceSource, their positioning in the market is likely to increase in the coming years. We'll continue to hold onto this name for now as the sell-off has just made their valuation cheaper.

-

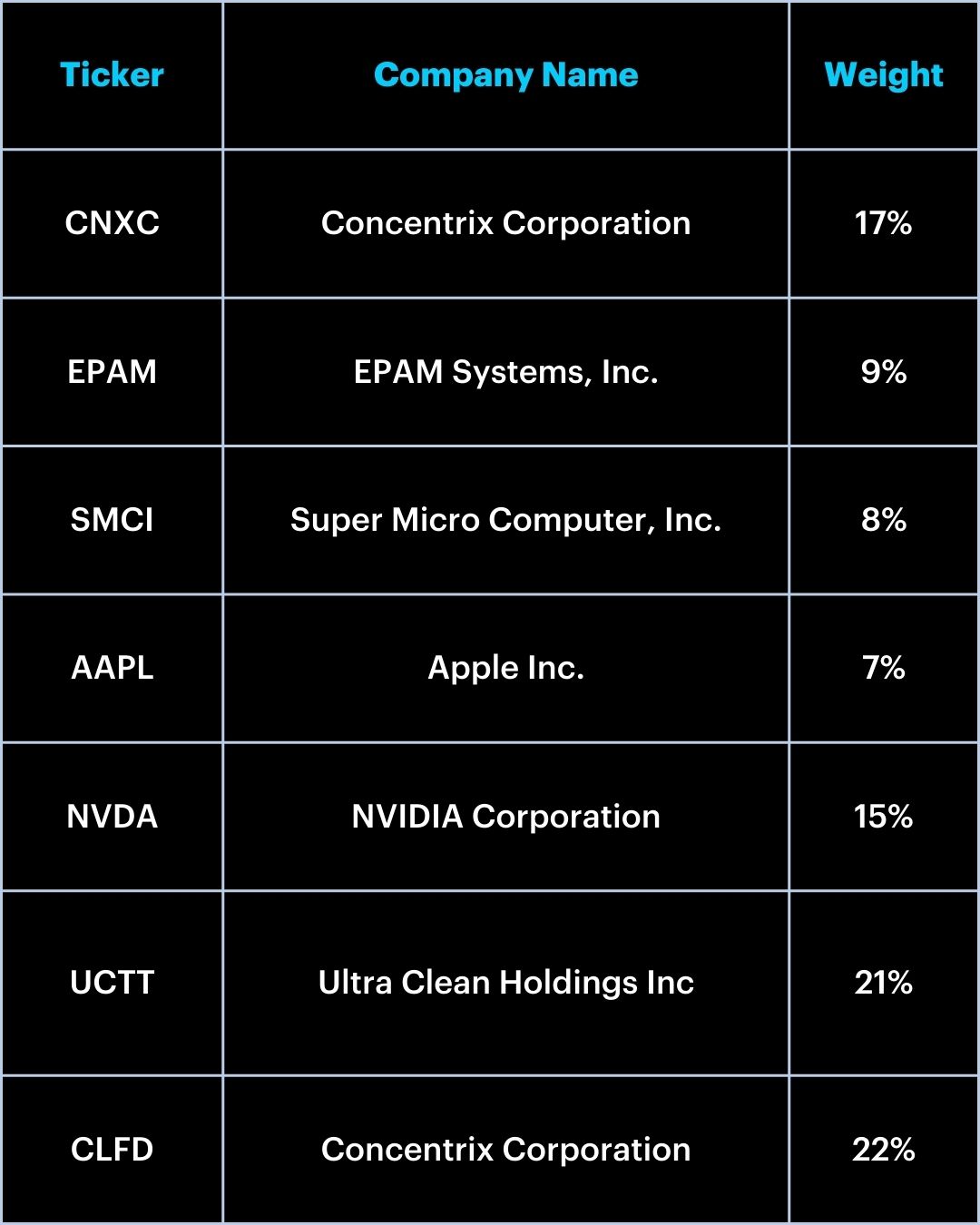

New Portfolio:

Old Portfolio: