The Moby Flagship Income Portfolio

Sep 08, 2022We're proud to announce that our Flagship Quant Dividend Portfolio has had yet another month of strong outperformance!

As we told you for the last two months, if you have been following along with the Moby Flagship Quantitative Dividend Portfolio, you should have continued to outperform the market while receiving over a 4% annual dividend.

If you're new to this strategy, the way it works is that we use AI & algorithms to build and manage a portfolio for you.

We have several different portfolios, but for this portfolio, the goal of it is to produce stable returns over the long term with passive income via dividends.

And when we see that not only is it delivering on that goal, but it's also outperforming the benchmark, we're truly excited to be able to help you achieve financial freedom.

Looking at the numbers more closely we see that (with the effect of dividends) the portfolio has had a 1-month performance of .54%.

While .54% may seem negligible, when comparing this to the market, we see that the S&P 500 is actually down -3.58% over that same time period! Even when factoring in the effects of the dividend yield of the market, we see that its total return is still at -3.28%.

Therefore this strategy is not only outperforming the benchmark while taking half the risk, but it's also paying out predictable and stable dividends.

Long story short, with strong outperformance over the market, this strategy is exactly in line with where we want it to be.

So, let’s get more granular and look at the performance breakdown of each stock within the portfolio 👇

Performance:

This month, the performance of each individual stock really start to deviate from the average as certain stocks did very well and others performed poorly.

Looking at the outliers, we see that COP & PFG performed very well, while MMM lagged significantly. So what happened with these 3 stocks?

-

ConocoPhillips (COP): If you're not familiar with ConocoPhillips, they've long been an energy stock that we've held in our portfolio. And this month, the stock has continued on its upwards trajectory -- taking advantage of sky-high energy prices across oil and gas. While there will be a reversion at some point, ConocoPhillips still has massive upside even in a world where energy prices stop inflating. What's even more is that after a strong 2nd quarter, ConocoPhillips increased their 2022 Shareholder Payout by 50%!

-

That's in part, why the AI has suggested increasing the weighting of COP in our portfolio from last month to this month.

-

-

Principal Financial Group (PFG): Unlike most other insurance companies, PFG has a large exposure to asset management and therefore is one of the more equity-sensitive companies in its peer group. And that's why, given the market correction we've seen this year, investors were concerned that their earnings would be under pressure. However in the end when they reported earnings, they proved to be much more resilient than expected as we saw EPS of $1.65 -- which was well above consensus estimates of $1.39. Past that, over the last month, we've seen investors push their projections for PFG upwards and that's why we've seen such a strong month from the legacy financial stock.

-

That's why this month, we're holding our 4% position in PFG constant.

-

-

3M Co (MMM): When you see a stock down 18% in a month, most people would panic and sell. But hey, that's half the benefit of using algorithms and AI to make investing decisions -- they keep your emotions at bay. And while there is still some uncertainty around MMM, the fact of the matter is that their business is stable and they're paying out over a 5% annual dividend.

-

That's why we're continuing to hold the name and will reassess our weighting for them next month.

-

While the heavy weight in MMM ultimately dragged down performance this month, we're excited to see that the rest of the names in the portfolio are still performing well.

So now that we've discussed the performance, let's finally get into the trades we made this month!

Model Changes:

-

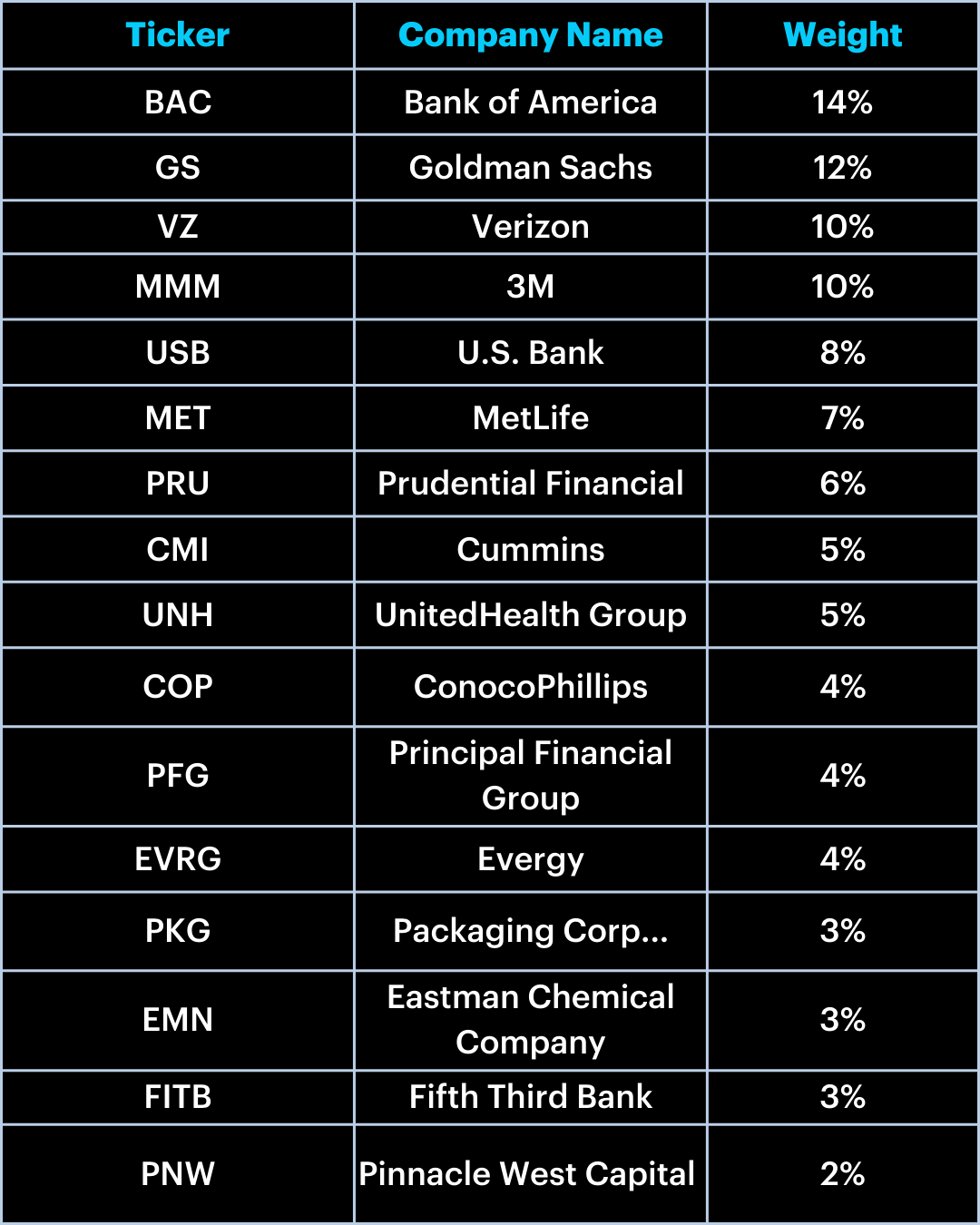

Old Portfolio:

-

New Portfolio:

Changes:

While there are some changes, most of the names in the portfolio remained constant. Therefore, let's discuss a few of the new trades for this month:

-

JPMorgan Chase & Co (JPM): Looks like the algorithm decided to swap out Bank of America for JP Morgan. While both stocks perform very similarly, JPM is more exposed to equity markets whereas Bank of America is more exposed to interest rates. In addition, JPM also pays out a higher dividend and should be slightly more aggressive over the next several months.

-

Exxon Mobil (XOM) & Valero (VLO): These two stocks' valuations are slightly higher than what usually makes this portfolio but a strong dividend and an even stronger return potential make these both a can't miss opportunity. After years of underperformance, energy is in the limelight this year.