Porsche: Biggest IPO of 2022

Oct 04, 2022Volkswagen finally spun out its most profitable brand: Porsche. Porsche IPO'd last Thursday on German exchanges and...wow.

It was kind of a dud.

Shares popped to 86€ before settling right near their IPO price at a comfortable ~82€ a share. This still makes Porsche nearly a 75 Billion market cap company--but usually the market sees an IPO with so little movement as pretty lame.

That's the thing though, we really like lame IPOs here at Moby.co. SPAC fever back in 2021 created some truly brain-breaking valuations for literally anyone with half a business and enough capital to afford the fees to get listed. It's nice seeing a middle-of-the-road, boring IPO for what is actually a pretty solid business.

But with any IPO, there is going to be a little volatility in the first few weeks. While we like Porsche’s current valuation, we want to offer a few other options in case the market catches a little buy-fever.

Let’s look at how to play this👇

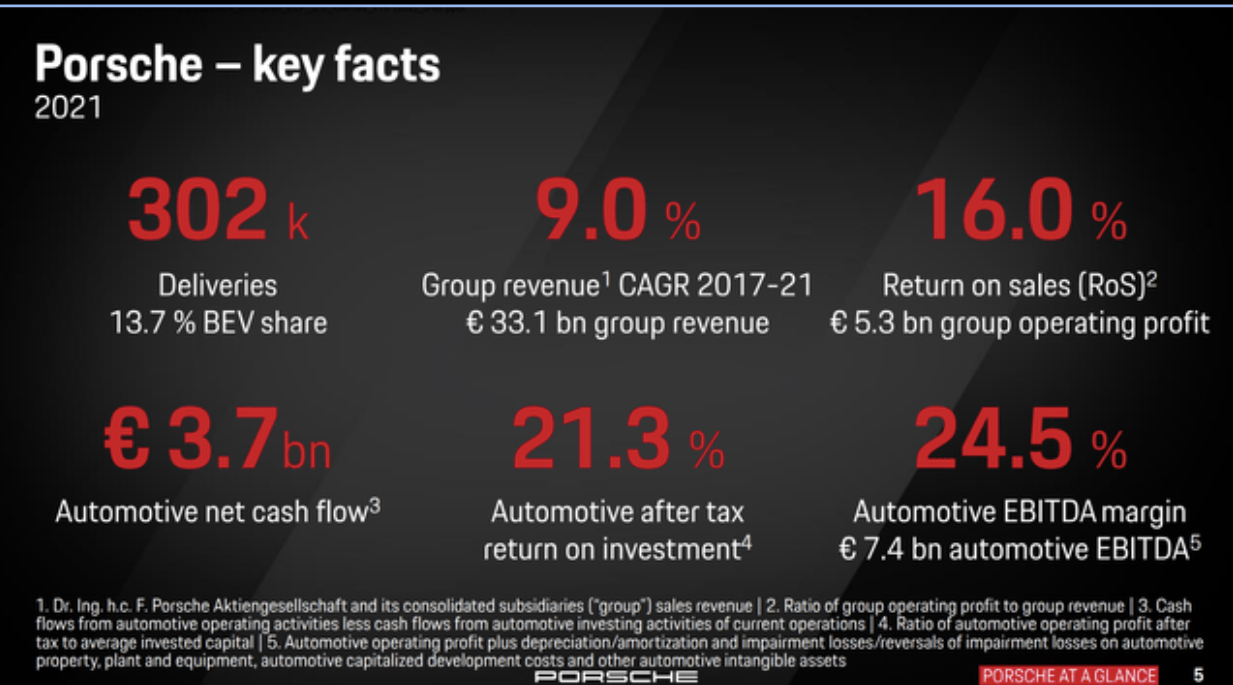

While that valuation seems good, Porshe’s long-term outlook really hinges on their EV push.

Their Taycan EV model has been really successful, and they have 3 other models they are actively developing. If Porsche can hit their goal of 50% electric sales by 2025, it can easily grow into this valuation and take off.

If they get stuck with a majority of complex combustion vehicles -- they’ll likely miss out on the margins that their 18x revenue valuation is currently counting on.

So if you're buying into this IPO, you need to be a believer that Porsche can hit these goals (or at least come close). For us right now, it's a bit early to confidently say wheter or not they can -- however they've shown to be making serious strides in the right direction.

In any case, Porsche is maintaining a close relationship with VW—who is putting truly serious money behind their EV initiatives.

We are therefore confident that this IPO is a huge step towards giving Porsche and VW the capital they need to fight for limited Lithium and Nickle resources as EV competition begins to seriously heat up in the next three years.

So growth honestly looks decent enough for us to be long-term speculative buyers, but the final factor to consider is that most of our audience is in the US, and buying Porsche stock comes with a lot of fees until they make a listing on a US exchange.

Porsche's growth trajectory looks like it can just barely edge out any inefficiencies that come from the hassle and fees that come from buying foreign stocks (depending on what brokerage you use). It absolutely can pull that off if they pull off an EV breakout, but that's really hard to predict as competition heats up.

However, if you want something a little less spicy given the fees you might have to pay to buy Porsche stock—this IPO will ultimately produce positive results for VW as well, so consider a buy there instead.

Regardless, we love watching new players emerge for the coming EV race of the mid 20's. It’s gonna be a wild ride, y’all