The Moby Offshore Flagship Fund

Oct 20, 2022Welcome back once again to the exciting world of Emerging Markets!

We usually update this portfolio about once a month in order to capitalize on any new or existing opportunities.

If you're new to this strategy, we highly recommend checking out how it works: here

But if you're a regular, let's dive straight into it 👇

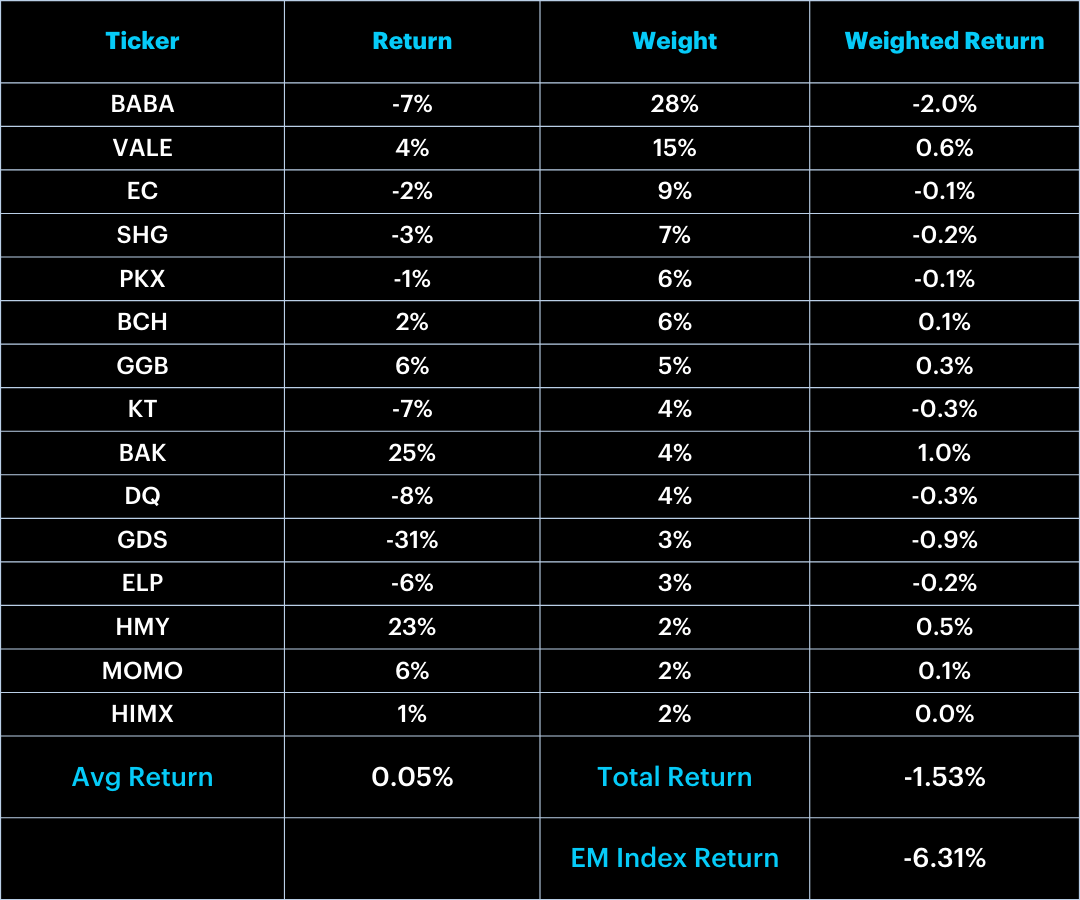

Performance Review:

Let's just say we're extremely happy with how our performance turned out this month.

While we are down 1.5% for the selected period, when we compare this to the index, we actually see we're up significantly -- as the index is down over 6.3%.

So why did our performance deviate so much from the benchmark? It helps that we had large allocations to steel & commodity producers who saw the prices of their goods increase in September.

And the reason for these allocations was due to our strategy being built around quality earnings growth and attractive valuations -- so we're still very confident with the positioning of this portfolio.

And that's why our portfolio remains relatively similar month-over-month.

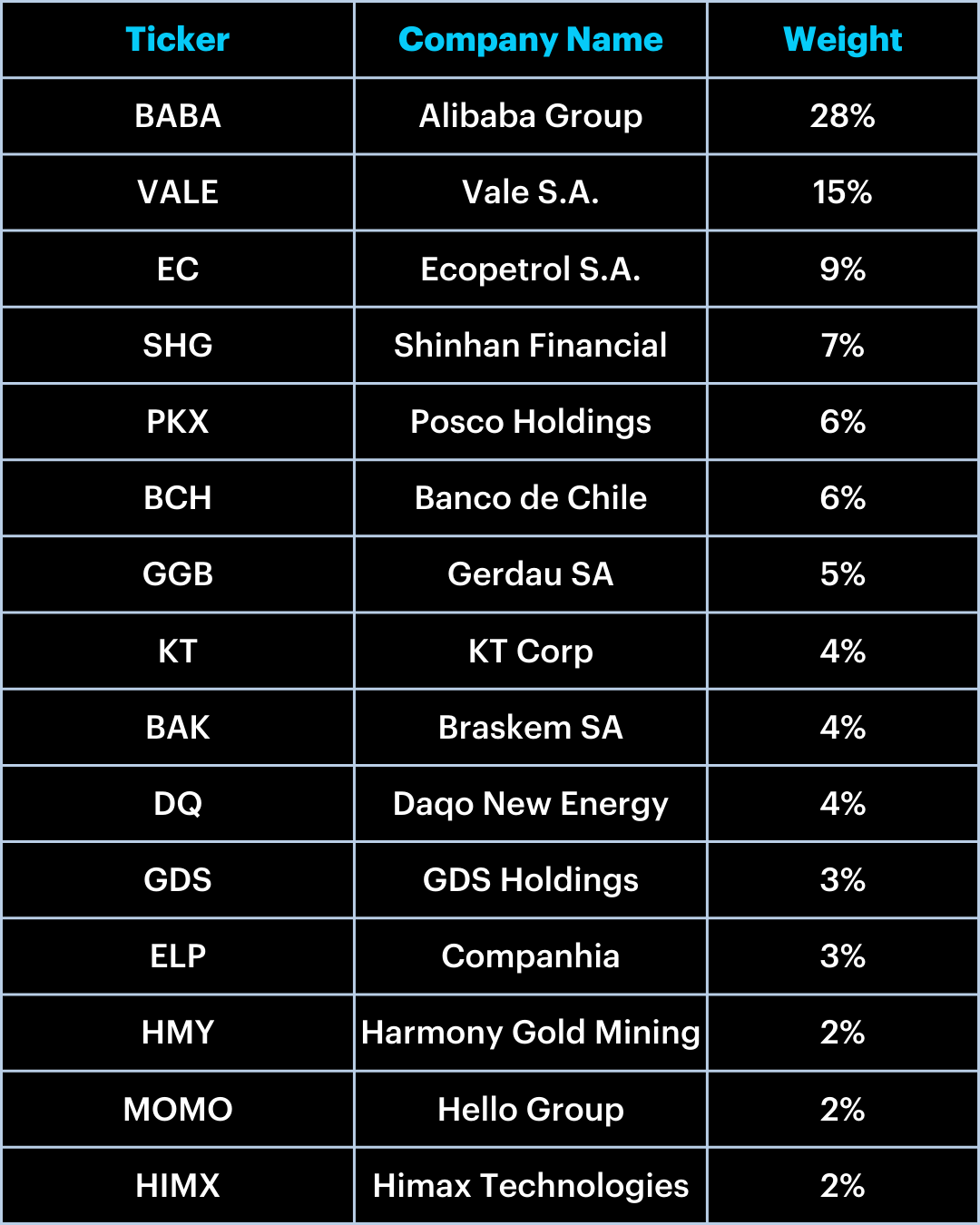

New Portfolio:

Old Portfolio:

Changes:

The strategy is largely unchanged with most of the stocks remaining in the portfolio, albeit at different weights. The only real change was with two stocks.

Let's discuss two of the changes:

-

Changes

-

One of the new names to the portfolio this month is Sociedad Químic (SQM). Sociedad Químic is a Chilean chemical company and a supplier of plant nutrients, iodine, lithium, and industrial chemicals. Make sure you don't skip over that key material of lithium. As the world’s biggest lithium producer, SQM is in an amazing position to benefit from the growing demand of Lithium. In case you didn't realize, Lithium is a key component needed in the production of car batteries. SQM should be able to benefit massively from this global demand and is already increasing revenues nicely!

-

The other new name to the portfolio that was added this month is via OMBAB: Grupo Aeroportuario Centro Norte. OMBAB is a Mexican airport operator and operates 13 airports in the central and northern states of Mexico. It is the fourth largest airport services company by passenger traffic in Mexico and serves approximately 15 million passengers annually. With air traffic ready to reclaim pre-pandemic highs, OMBAB is perfectly situated to capitalize on increased air traffic throughout Mexico!

-