The Video Game Empire You've Never Heard Of

Feb 08, 2023Price Target: $120 (30% upside)

Current Price: $88

Target Date: Q4 2023

Stock: NetEase ($NTES)

Since our last report on Chinese gaming titan NetEase ($NTES) -- we've gotten some solid updates about their gaming pipeline that are making us more and more bullish for 2023.

To rewind real quick, the gaming industry as a whole has been jammed up for the better part of the last 3 years and we're only seeing the broader recovery as we enter the middle of Q1.

Companies like Tencent are finally on the right path and it looks like NetEase is playing the same game.

NetEase has had solid success on the back of their battle royale party game Egg Party and that's really just the beginning for 2023.

Some of NetEase's biggest franchises finally got approval for mobile licensing in just the last few weeks -- which is speeding up a potential release timeline.

In particular, we're bullish on the mobile portion of NetEase's groundbreaking MMORPG (massively multiplayer online role-playing game) Justice Mobile. After that, we're eager to see how well their entry into the Harry Potter franchise does.

But this isn't just about new releases, it's about NetEase diversifying and finding new footing to do well in the new normal for gaming. Free-to-play games are becoming truly wild profit drivers, no matter how counterintuitive that may seem.

We'll make this one quick, as the numbers speak pretty loud on their own👇

NetEase Update:

In case you're new here, NetEase is a gaming studio based in China.

They mostly develop PC and mobile games and are quickly becoming one of the biggest game developers in the world thanks to international licensing and partnerships.

You have large portfolios like this for a simple reason: the model is repeatable and the gaming market can be pretty hit-or-miss with how well your IP resonates with a mass audience.

But, sometimes in gaming, you strike it really big, and NetEase is no exception.

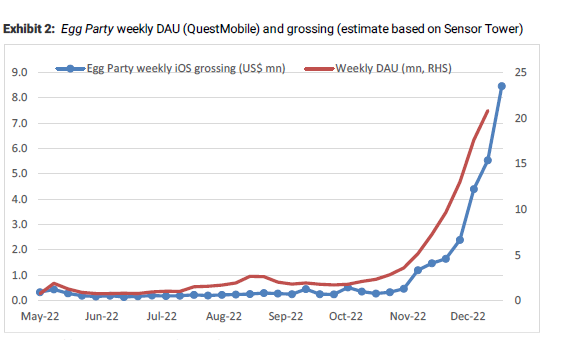

Over the last 4 months, their title Egg Party has rocketed to huge levels of success -- becoming the #5 mobile game in China as measured by Daily Active Users.

But more importantly, with the success of Egg Party's DAU numbers, came equally impressive revenue growth:

Egg Party's big success came after NetEase's last earnings call, so we're really eager for their Q4 report set to drop later in the month as we get better confirmation of the growth here as well as updated reports for their 2023 release schedule.

Egg Party is set for a limited international beta, being tested in the UK and the Netherlands before NetEase spends the resources necessary to capitalize on a partnership with 4 Winds and bring EP to the US.

The big game we're excited about in H1 2023 is Justice Mobile -- which is a mobile version of one of the most popular MMORPGs of all time.

Justice Mobile has netted over 10 million registrants for its first beta that launched right after our first report on NetEase back in September. That level of excitement is pretty rare and we anticipate a more linear growth track than Egg Party. But we do expect solid revenue growth for NetEase in total after the game releases (potentially) ahead of schedule in Q2.

That kind of double-whammy is rare, and more a symptom of weirdly compressed development cycles extending from 2020's disruption of the Chinese working economy.

We'll gladly take the gains though, and are excited to watch NetEase achieve some international growth as well.

Areas For Global Dominance:

After Justice Mobile, we're expecting the release of NetEase's next entry into the Harry Potter Franchise.

Harry Potter: The Magic Awakened is going to be a global mobile MMORPG that's more focused on a card game mechanic.

The big market here is actually APAC as we're anticipating HPTMA to have more of an audience in Japan.

The Japanese market is gearing up for a new Harry Potter World theme park in Tokyo that will tie HPTMA into its marketing push -- which will boost initial revenue for the game.

Along with Egg Party's European/ US rollout in 2023 (where the popular Fall Guys has already proven the market for this style of game), NetEase is gearing up for a lot of international expansion in 2023.

While monetarily a lot of that expansion will be tied to the APAC region -- this is still giving NetEase enough footholds in Western markets to make a bigger push through the back half of 2023 and into 2024.

NetEase Outlook:

With a robust release timeline in 2023 and a wildly diversifying revenue base, NetEase is looking solid ahead of its earnings call on February 23rd.

Their valuation is solid compared to their peers and their revenue is about to get a big shot in the arm.

The next big thing NetEase needs to accomplish is a more robust rollout of international expansions and western AAA titles leading into 2025.

Their acquisition of Skybox Labs back in January gives them critical footholds in the western AAA market, but it will take a lot of development and a few years before we see that acquisition really bear fruit.

All-in-all, NetEase is simply in a quick breath before making some major leaps. It's an exciting time to keep adding to our position and we can't wait to see what's coming next for them.

Risk/Reward: Medium / Medium

Rating: Overweight

Dividend Yield: 1.7%

Market Cap: $58 Billion