Microsoft Earnings: Why Shareholders Should Be Happy

Jul 27, 2022While the market is taking a hit over retail fears — we’re taking another look at our picks that are a better fit for this downturn.

The good news from our perspective is that this bear period is really starting to take shape. Our bear market is being largely driven by inflation and rising interest rates.

But the inflation we’re fighting is atypical because it’s being pushed more by continuing supply chain and energy price woes.

While some of those inflation pressures appear to be trending in the right direction — we’re still a quarter or two away from a clear path out of this.

This is why we’re still bullish on companies that play more in information technology, software, and anything fee-based in this environment. Even though tech is down overall, necessary services like cloud computing still have a lot of room for growth and adoption.

And even with supply chains and semiconductors dragging down PC sales and valuations — Microsoft is still poised to outperform a recession and thrive in a shorter-lived bear period.

The thesis is essentially the same: Azure and One365 and Microsoft’s bundling strategy are going to carry their PC and retail businesses as they become the preferred cloud provider for enterprises looking to modernize their architecture.

Price Target: Go Premium to Unlock 🔐

Target Date: Go Premium to Unlock 🔐

Rating: Go Premium to Unlock 🔐

While Azure will (probably) never take the top spot from AWS, 2nd place in cloud is looking more and more like the growth position.

Check it out below👇

Microsoft Overview:

So as we mentioned last time, Microsoft is already in a really strong position.

They’re up 50% YoY from 2021 – which is right in line with their 2020 to 2021 growth.

Microsoft has been slowly diversifying and consolidating its position as a software and services behemoth on top of their hardware, gaming, and OS foundation.

However, the headlines are shifting a little bit on the retail side as Walmart is spooking the whole market about just how hard it is being a retailer of any kind right now. That’s why Microsoft was down so much pre-earnings. These retail numbers were spooking the market — but with Azure putting up strong revenue numbers and Alphabet’s ad business not getting kneecapped as much as expected, the market can forgive weaker retail numbers.

But anyway, let's get into the specifics of those numbers:

Azure Outlook:

Cloud is king in this environment.

It is a brilliant, high-margin business that is difficult to enter unless you have the infrastructure of a tech titan like Microsoft, Amazon, and Google. (check out our initial analysis: here).

Cloud growth is looking strong. Q2 Earnings weren’t quite as bullish as Q1, but Q2 was a strong period of pullback in high-growth tech startups that have relied on cloud services from the ground up.

But that’s not the core of our thesis here.

In Q1, Enterprise cloud was up 6% YoY while in Q2 it maintained that growth.

That’s all we need to know to be comfortable with our trendline.

Because most of the growth coming in the cloud space is coming from enterprise and mature businesses as they take advantage of this period of cost-cutting by modernizing their architecture.

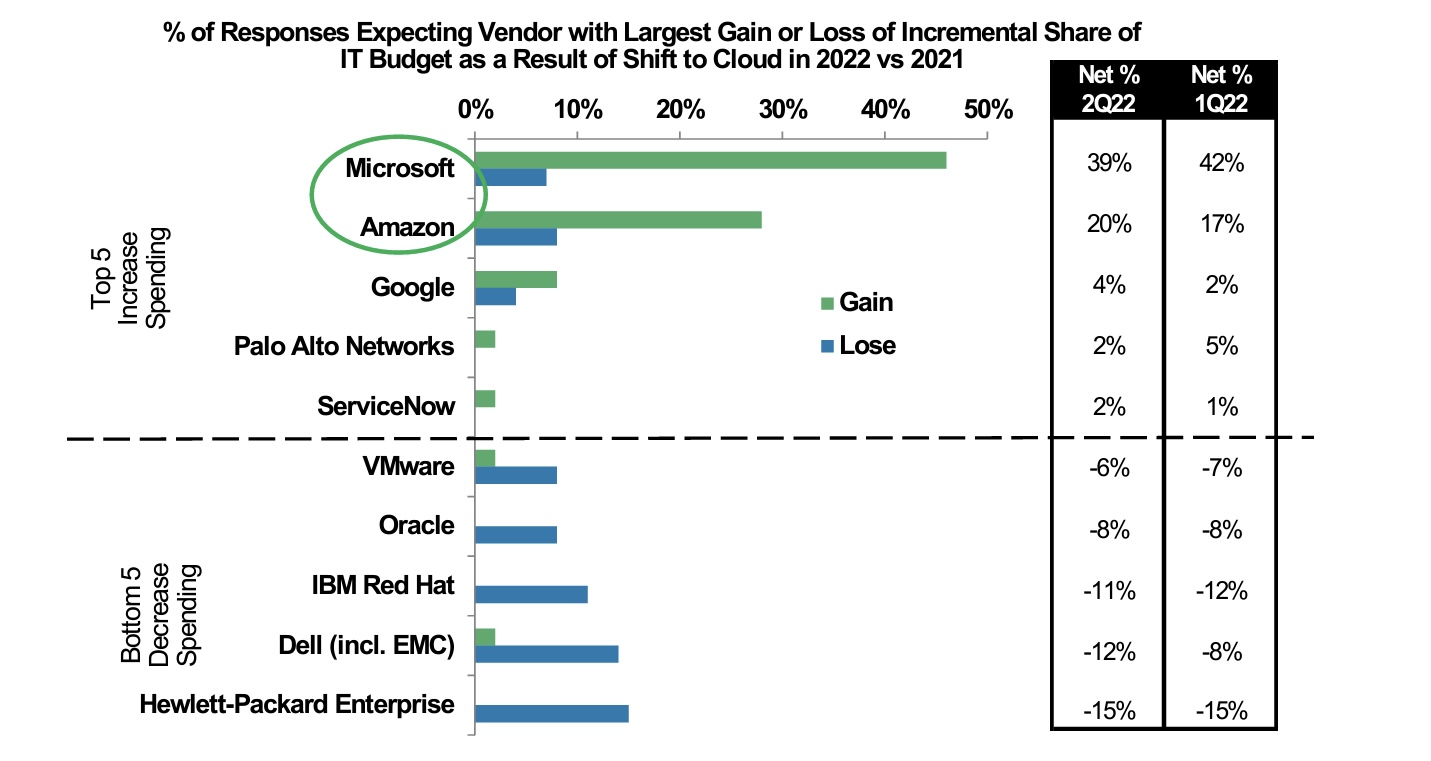

And Azure is looking like the strongest candidate to take the lion’s share of that growth:

The enterprise angle here is key because:

-

Those deals have a larger contract dollar-value and longer renewal time.

-

Microsoft is the absolute emperor of bundling software.

That second point is critical because what we’re seeing in these earnings reports is a slowdown in YoY growth in the number of Azure seats sold.

The market may get spooked by this in the short term as the market is basically looking for any excuse to get spooked right now. But here’s a quick aside before we talk about bundles:

We like Azure even as YoY growth decelerates because Cloud Computing is such a wildly high-margin business. Azure Revenue is based on seats and usage — which means revenue can still increase at a solid clip even as customer and deal growth goes down.

But, back to bundling:

A second line will carry MSFT long-term even as Azure growth (potentially) continues this slowdown. And that’s Office365.

Microsoft is currently getting more and more office customers to use Azure by bundling seats with Office 365 and vice versa. Azure growth will carry Office365 and Office365 will make Azure stickier.

That’s why we love Microsoft long-term. After Apple completely overtook them in the personal computing space and created the luxury operating system of individual customer households, Microsoft decided to take a similar approach to the B2B model.

Microsoft is rapidly regaining ground as the table-stakes software ecosystem for mature businesses and enterprises.

Office 365 growth is starting to accelerate, and these large deals will have the staying power to maintain Microsoft’s comparative growth through the remainder of this downturn.

And that's why both of these should lead Microsoft towards double-digit revenue and operating income growth over the next 2 years.

Microsoft Outlook:

It’s genuinely an interesting time to be in certain sectors of big tech. Alphabet and Meta are going to be in a difficult position for the medium-term as advertising budgets tighten.

That downward momentum is going to place unfair pressure on Amazon and Microsoft, leading to them potentially being a little oversold.

But the headwinds for retail will be shorter-lived than those for advertising. So any positive direction on supply chains and retail will bring a lot of buying momentum to these two.

Stay tuned for our Amazon analysis later next week.

The dynamics between AWS and the Amazon e-commerce business are much different — but the result is really interesting.

Meanwhile, Microsoft is firmly establishing their business as the medium-growth, long-term powerhouse for business and niche consumers.

They’re winning the right battles at the right time, and are only being mildly tripped up by the specific macro headwinds hurting some of the other big players in their cohort.

Ticker: MSFT

Risk/Reward: Medium / High

Market Cap: $1.89T

Dividend Yield: .98%