Is Now the Time to Buy Intuit Stock?

Oct 05, 2022Price Target: $500 (24% upside)

Current Price: $402

Target Date: Q3 2023

Rating: Overweight

As we move into the next era of this tech boom, the trend our analysts are the most excited to watch is big data.

The 2010–2020 bull run produced a HUGE array of software companies. A lot of them were bogus, but a few managed to become powerhouses.

Here’s the next step of that tech boom: as tech companies consolidate, we want to see silos break down and products integrate.

This was the promise of Adobe and their creative cloud platform, but we really haven’t seen results from all their consolidation.

Where are we starting to see solid results? Intuit ($INTU).

Intuit has made a focused number of extremely smart acquisitions over the last 5 years and is finally removing the barriers between those companies. Their product suite is poised to be an SMB necessity in the next 5 years.

With TurboTax, Mint, Quickbooks, and MailChimp—Intuit is setting itself nicely up to be the small business operating system all LLCs/partnerships need. At their investor day in late September, we saw a company poised to create a TON of efficiencies based on integrations between all their services.

Intuit is also about to double down on live services and open up a wide new TAM across the next 5 years. No matter what, we see a stock that has been mildly battered by the 2022 downturn that can be a solid discount pickup for long-term investors.

There are a lot of details to cover, so let's get into it. 👇

Intuit ($INTU Overview):

Intuit is a classic SaaS platform best known for Quickbooks and TurboTax.

They also have products: Mint and Credit Karma -- which are personal finance platforms for individuals. Their highest profile acquisition in the past few years has been Mailchimp: a beginner email marketing solution that you may remember from literally every single podcast ad from 2014–2016.

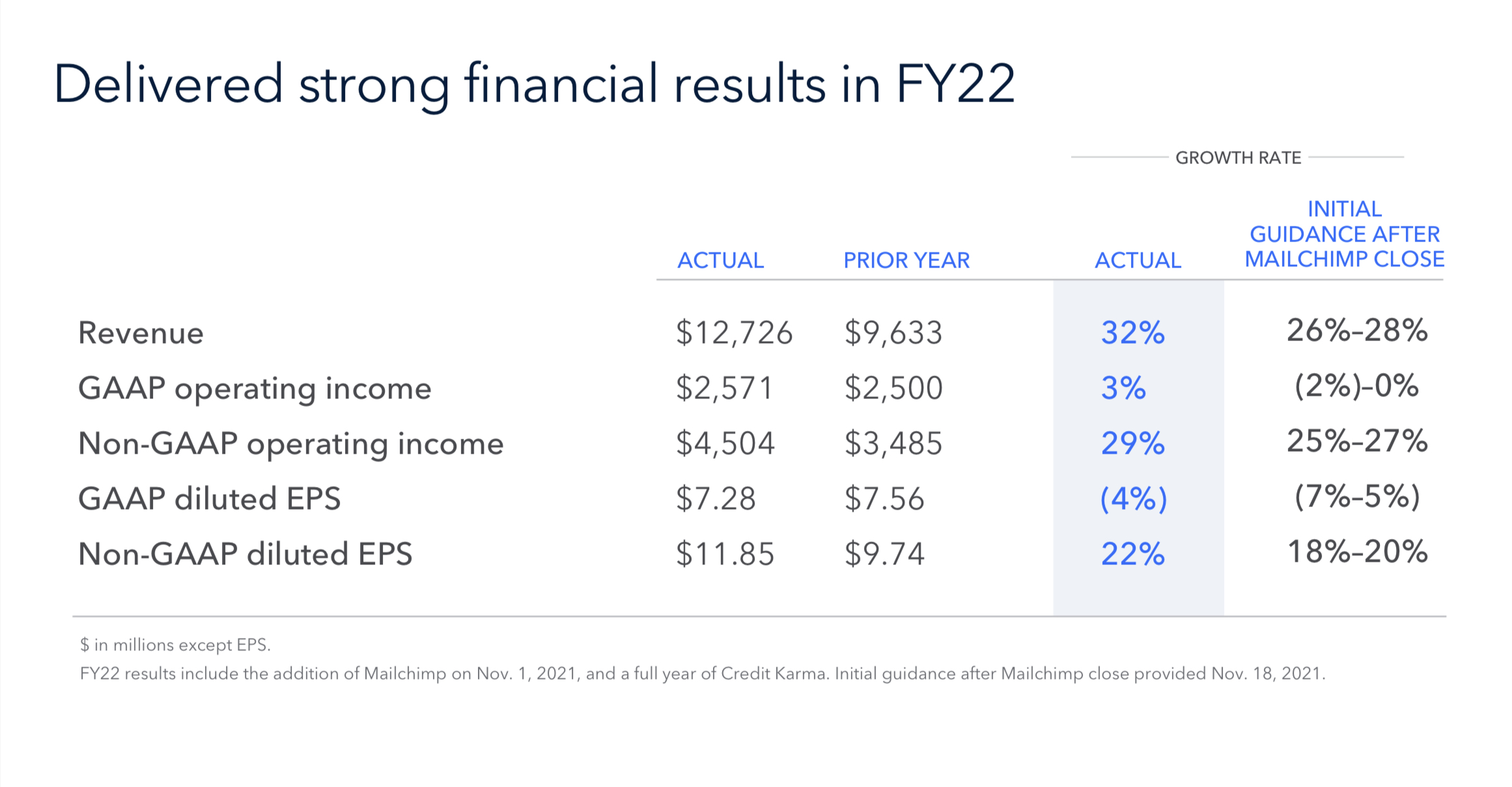

But Intuit has been smart about revenue growth across these platforms. This is a classic “boring is beautiful” play:

Turns out, even with inflation—you can still pull off some decent revenue growth in the era of the Great Resignation and everyone on earth starting a small business/side hustle.

While some of the numbers left room for improvement (which is totally normal after an acquisition), the key was in how successful they integrated the new Mailchimp team.

Intuit has a history of being moderate in its predictions, so seeing all of these numbers surprise to the upside is extremely encouraging.

But we care more about future growth here, so what do we mean when we say that Intuit is breaking down these data barriers?

Becoming a Full Suite:

When you service people for taxes, marketing, and accounting -- you’re going to end up with a huge pile of very actionable data.

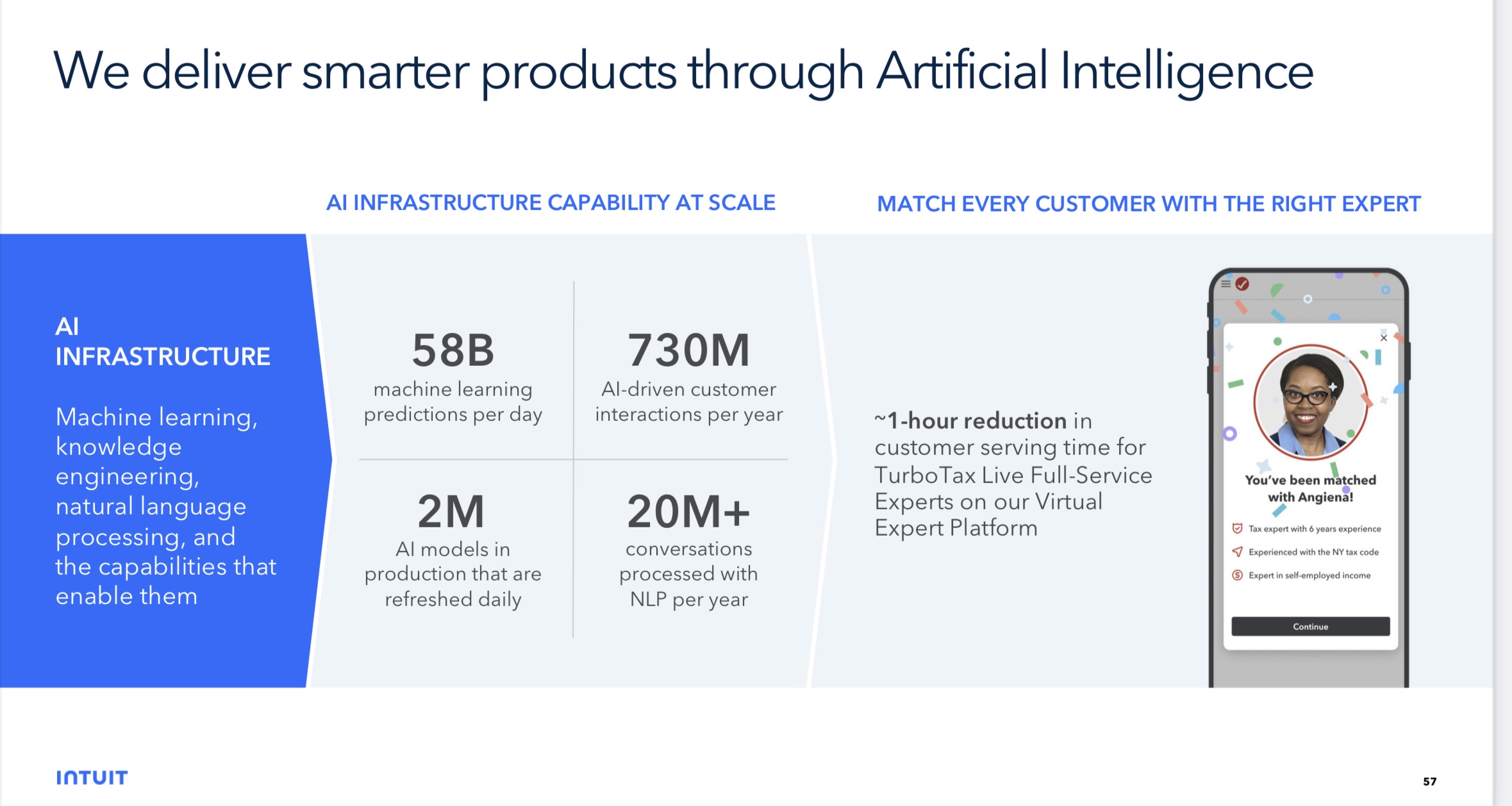

What’s impressed us the most about Intuit’s growth has been how they’re using AI to make its product better, make smarter predictions, and expand how their product team improves those services.

What we love about this is simple: Intuit can accelerate growth and more quickly integrate future acquisitions now that they have this big pile of unified data to play with.

They can also use their predictive models to create better services -- like a live service model for LLCs within TurboTax and QuickBooks they plan to launch next year.

Rather than burning cash on an army of accountants, Intuit can use AI to empower a smaller team to service a larger number of high-ticket customers. It’s the SaaS dream in the way that only Intuit has managed to actually pull it off in the real world.

Multiple Paths to Expand TAM:

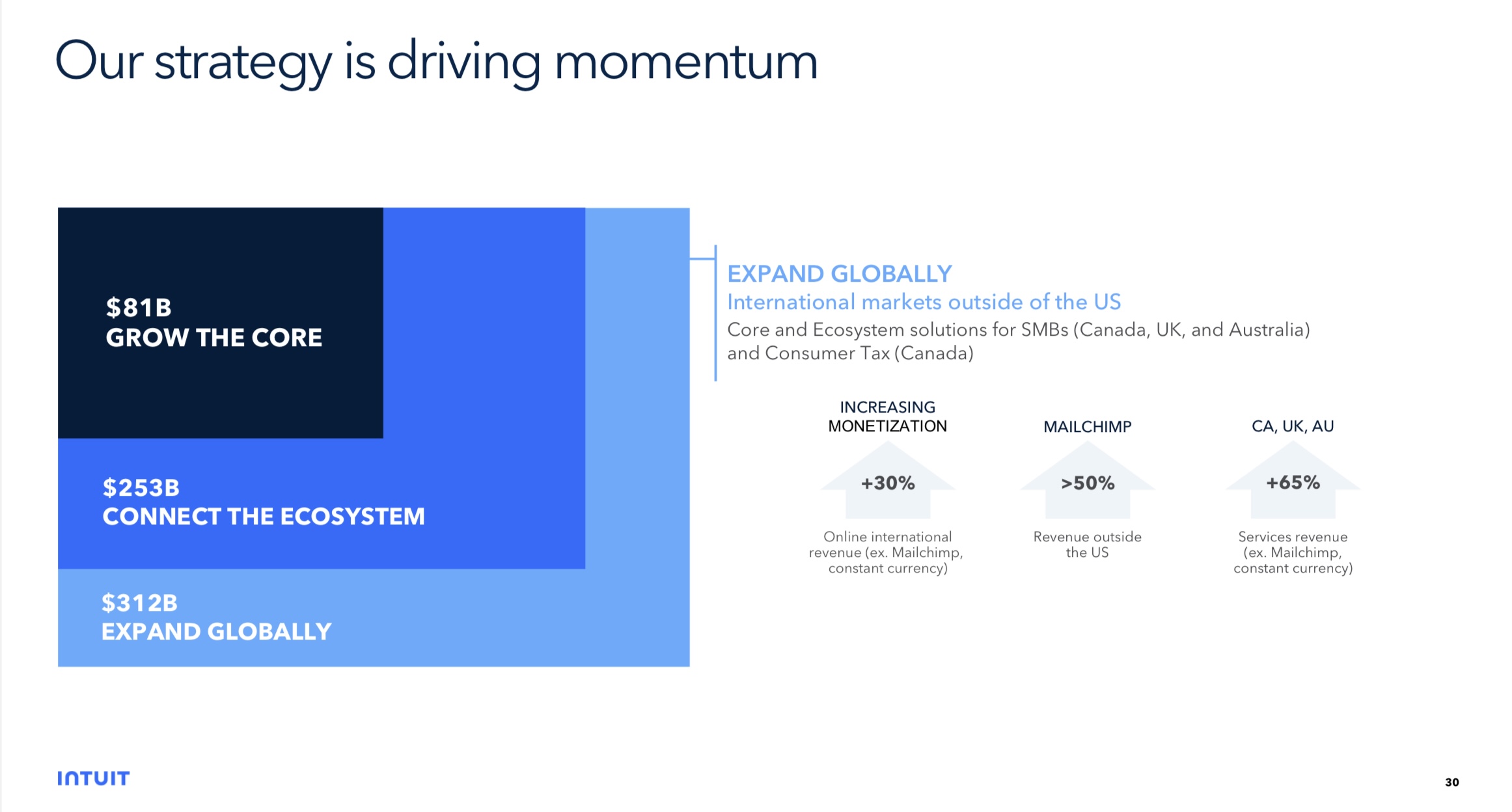

Furthermore, all these services integrating will give Intuit the ability to break into a much larger, much less saturated TAM moving forward:

The same data pool that allows Intuit to create and integrate new services so quickly also allows them to rapidly expand into new sectors. This connected ecosystem puts Intuit into a position where they become a necessity for basically every kind of small business and LLC.

But the biggest and potentially lowest impact TAM boost is coming from their push into Canada, the UK, and Australia.

Intuit and its subsidiaries have a track record of establishing whole categories of services. Had you even heard of email marketing before Mailchimp took over the internet back in the mid-teens?

Right now they’ve barely cracked 5% of their total potential saturation. This TAM and international expansion are what make us the most bullish about Intuit’s growth moving forward.

Intuit Outlook:

This was easily one of the most boring pieces of analysis we’ve done in a while.

That’s the peril of good SaaS businesses. It’s hard to talk about something as incredible as breaking down data silos in a way that’s actually exciting.

There is a huge amount of effort that goes into integrating such disparate data systems with each other -- especially when the reservoir of data is so large.

But the results are genuinely exciting to see in Intuit’s growth potential both internally and externally. Getting these different data systems to talk to each other and create predictive models is something that only really accelerates with time.

Even with a looming recession and rising costs, the SMB boom isn’t going anywhere anytime soon. If intuit manages to pull off even 25% of what they want to, they will become a no-brainer essential for every kind of business across the US, Canada, Australia, and the UK.

We're really excited to see just how far they take this thing.

Risk/Reward: Medium/Medium

Ticker: INTU

Dividend Yield: 0.77%

Market Cap: $114B