Intercontinental Exchange Inc: Growth at a Reasonable Price

May 24, 2021🚀 Know The Company

Market Sector: Financial Services

Market Segment: Financial Data & Stock Exchanges

Products: A leading exchange operator and data service provider

Scope Of Activity: Operates 12 exchanges (owns NYSE), 6 clearing houses, offers data services

Competitors: CME Group, Nasdaq, S&P Global, HIS Markit

🔑 Key Takeaways

- Intercontinental Exchange operates in a duopoly. It benefits from regulations surrounding stock exchanges and has moats like scale, technology, and a strong reputation for reliability.

- Additionally, the stock market transactions are somewhat recession-resistant and deliver stable revenues. Intercontinental Exchange is leveraging its expertise in data through subscription-based offerings which are expected to drive future growth.

- The valuation is not overblown and the price is close to a support zone. This stock would be a good pick for the long term.

📊 By The Numbers

- Intercontinental Exchange is a Fortune 500 company that was founded as recently as 2000. During the past 20 years, the company has grown to become one of the leading operators of market exchanges and clearing houses in strategic centers of the financial world. Intercontinental Exchange also owns the NYSE, which competes with Nasdaq for company listings.

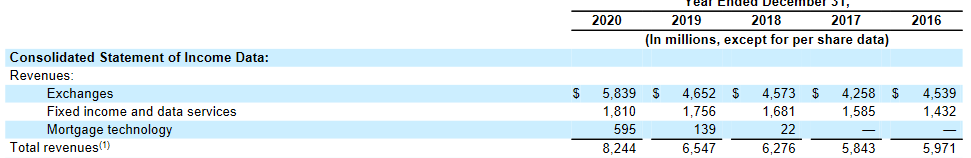

- Intercontinental Exchange has three business segments, exchanges, fixed income and data services, and mortgage technology. The exchanges segment is by far the highest revenue generator with a share of over 70% of total revenue through the past 5 years. The fixed income and data services segment is the second-largest with a revenue share of around 22-27% through the past 5 years. This segment deals in providing data services for fixed-income securities.

- The mortgage technology segment connects all stakeholders across the entire mortgage supply chain and removes information inefficiencies. In conclusion, the company basically makes money by either selling data subscriptions or by charging a fee for every transaction done on its exchanges or clearing houses. While not a "household" name, ICE is a silent killer in the fintech industry. The graph below shows the breakout of revenue streams

📈 Growth Opportunities

While the financials are exciting ICE still has a lot of room to grow (the title of this post, is our thesis on them - a company growing but not at a crazy valuation multiple). Their largest growth segments are as follows:

- Exchange Segment Growth – Since the exchange business is the most significant, investors would want to know how it is performing. In general, the transaction-based revenue from exchanges and clearing houses is a direct function of the number of transactions that happen. Exchange revenue also has a recurring revenue component with data services. This sub-segment has grown significantly in recent years.

- The Average Daily Volume and the Rate Per Contract are also important metrics because they reveal how many transactions are taking place and how much Intercontinental Exchange is able to monetize from those transactions. With transactions trending in the right direction, overall volume for ICE should maintain in an upwards trend! This is something we as investors love to see when investing in growth stocks.

- Fixed Income And Data Services Growth: The second largest segment for Intercontinental Exchange has been growing at a slow and steady pace. However, margins have been remarkably consistent. Like we've discussed in past posts, margins are a great way to show how powerful drivers of revenue are and with margins keeping up, we know there is a lot of revenue retention - which we love to see!

- Mortgage Technology Segment Growth: The Mortgage Technology segment is a new one and a relatively small one for Intercontinental Exchange. It has witnessed high growth in recent years. While it makes up a small piece of their overall business, the high growth (if sustained) can be a future driver for them!

Competitive Advantages:

Moving on past the growth factors, ICE is also a defendable business! What we mean by that is the stock exchange industry is a essentially a duopoly with 2 participants - the NYSE and the Nasdaq. Even in the futures/commodities space, Intercontinental Exchange and the CME Group are the two major players. This industry is also a regulated one and it would not be easy for a new player to enter the market. Therefore we do not foresee anyone coming in and carving out market share from them. What does this mean? This essentially keeps their profits locked-in. The only true competitor would be volume lost to alt-investments such as things like crypto that isnt on an exchange (yet).

Moving past their market competitors, their technology is also far superior. Since high-value transactions take place on exchanges, they have to be secure and reliable. The transactions are also time-sensitive. As an investor, you would want the exact price movements in real-time. So, the technology infrastructure has to be robust and fast. Lastly, the cost per contract to the investors also has to be low. Unless someone steps in and can outperform them (which would be hard) they can continue to win out deals. Additionally these costs often go down with scale so beating them on price as a new market entrant would be near impossible.

Data services and analytics is a high-growth area for Intercontinental Exchange. In a world where data is the new oil, there is a demand for transparency, high-quality information, automation, and secure data. Subscription revenue from data-related services has been growing at a strong pace and is expected to continue the upward trajectory. Intercontinental Exchange already has extensive expertise in building data and then selling it.

💰 Valuation

Intercontinental Exchange currently trades at a P/E ratio of almost 30. The 5-year average is around 24. Meanwhile, the price-to-sales ratio is 7.3 while the historical average is 7.2. The price-to-book ratio is 3.1 and the historical average is 2.7. For comparison, the CME Group trades at a P/E of 40 and has a price-to-book ratio of 2.9. Nasdaq is trading at a P/E of 25 and a price-to-book ratio of 4.

Intercontinental Exchange has grown its dividends every year since 2013. It currently trades at a dividend yield of 1.1%, close to the 5-year average of around 1.2%. The price of $111 currently is very close to a major support zone at $109-$110. The stock has been range-bound since late December 2020. A reversal from the $110 zone is the best place to go long. On the other hand, a breakdown below $110 would signal a wait-and-watch approach. Either way in the long term we have and continue to be investors of ICE. If you're a long term investor this is a great play for you. If short, please re-read earlier in this paragraph!

Ticker: ICE

Rating: Overweight

Target Price: $130

Target Date: 7 Months

Market Cap: ~$64 Billion

Stock Price (May 24, 2021): $113