Is This A Top Value Stock?

Dec 14, 2022Price Target: Go Premium To Unlock

Current Price: $53

Target Date: Go Premium To Unlock

Stock: Ingersoll Rand ($IR)

Well, folks, you know the downturn has us digging deep into our defensive picks bin when we start breaking out the unsexiest industrial stocks.

And believe me, there is no bigger proof of our philosophy, Boring is Beautiful, than this next stock.

What we're seeing in this downturn is flat-to-increased economic activity while growth areas get hammered by the Fed turning off QE (i.e. the market's 'free money' pump).

This means that growth stocks get hammered by even hints of bad news while industrial stocks keep pushing forward despite macro trends.

Because we're still building infrastructure and that infrastructure needs to be maintained.

And a big beneficiary of that is the compressor king: Ingersoll Rand ($IR)

Rand has managed to whether getting spun at basically the worst time (2020) and grow well despite all the headwinds they're facing.

Both of their major businesses (compressors and pumps) are up big this year and they look like they're poised to keep breaking out.

The details sure won't be interesting, but as an investor, it's important you find stronger defensive picks that don't get buffeted by volatility quite as much.

There's a lot to build toward in this one, so let's get into the details👇

Ingersoll Rand Overview:

We gotta keep this one quick: IR is the #2 player in the broader compressor industry.

Technically they've been around since the 19th century, but a few strategic acquisitions allowed this current iteration that focuses on pumps to be spun in 2020.

But yes, this is a company that makes compressors, pumps, and other precision equipment for factories and other industrial uses.

Basically, if you've got air or water or any kind of fluid and you need to move it from one place to another, IR is going to be one of your best bets.

Despite being in second place behind Atlas Copco in Sweden, IR is making a strong name for itself by expanding margins and building a strong culture of worker ownership.

How IR can Beat the Market:

The opportunity here is simple: the compressor space is pretty fragmented and disorganized outside of the top 2 spots.

IR is positioning itself as a strong player that can organize the more complicated side of the compressor industry and achieve solid growth that stays in line with a market that has the potential to shift back to growth stocks in the long term.

In the short term, they're simply a solid defensive pick. But any industrial stock is going to be good for your portfolio right now. We want to ensure that you win for the long haul here.

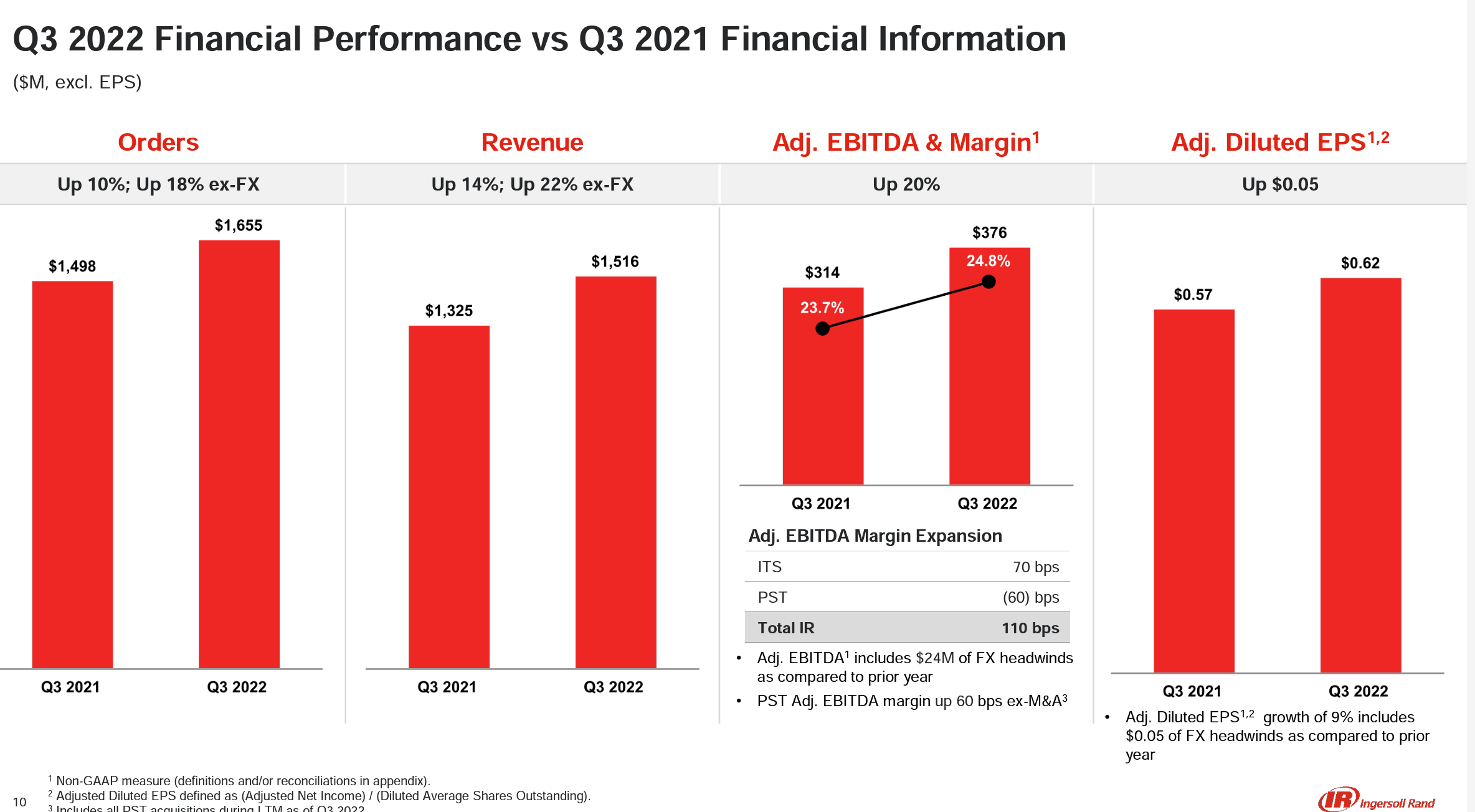

And based on IR's latest earnings report--they're starting to realize that vision of building out a more unified compressor industry:

We would have wanted to see slightly higher growth numbers here, but seeing a lot of this being chalked up to FX (foreign exchange) makes a lot of sense on our end.

With an improving macro environment, IR is setting itself up to generate $1 Billion in Free Cash Flow. And if you've read any of our research lately, you know Free Cash Flow is KING.

Basically, the goal here is for IR to manage costs in the same way they currently are, which will allow them to make more strategic small-cap acquisitions across the compressor and pump industry.

The cash flow we're currently seeing is going to allow them to reinvest a lot in the business, and their executive team has some of the best minds from previous industrial consolidations across several sub-industries.

Ingersoll Rand Outlook:

This is what this wild year has done to us.

We're on the internet telling you to buy compressor company stock. But one key thing to keep in mind is, we're only trying to make these defensive investments if we think they can also outperform once the economy gets back on track.

IR has demonstrated that they can expand profitability enough to start expanding their business even in the direst of economic circumstances, which gives them our vote to maintain that growth as the macro environment turns more bullish.

Sure, this is literally the least sexy pick we've probably ever initiated coverage in, but it's the duller-seeming stocks that buttress your portfolio while the bigger winners get hammered by volatility.

Stick with value plays like this one and it'll provide a firm foundation for your portfolio across the next 5 years.

Rating: Overweight

Market Cap: $22B

Dividend Yield: 0.15%