Flagship ESG Portfolio

Oct 26, 2022There is an old saying that goes, "If it ain't broke don't fix it".

And while there usually is some truth to these old idioms, in the case of our ESG portfolio, while the portfolio is far from "broke" there's always some room for improvements.

And over the last several months, while the portfolio has nearly 2x'd the market, we need to still find ways to make sure that our outperformance persists.

That's why this month, while we aren't making a ton of changes, we are making slight tweaks to the portfolio in order to make sure you're not only investing responsibly but you're also maximizing your upside potential.

So with that context, let's get into the ESG portfolio updates 👇

ESG Overview:

But before we dive into our portfolio's updates, it's been awhile since we last made trades in this strategy.

Therefore we want to give you a brief refresher on the goal of this strategy.

If you want to re-read the entire thesis, then just click here for the original post. Or if you already know about ESG strategies, then just skip down to the newest trades below.

The goal of this strategy however, is to invest in companies -- ethically. What does that mean?

Well at a high level, ESG strategies help you invest in a way that reflects your values -- in a way that considers the impacts of the companies you invest in.

Therefore our ESG (Environmental, Social, and Governance) strategy is focused on investing in companies that are contributing to the world as a whole.

In a nutshell, we're looking at three factors:

-

Environmental: This relates to a company’s negative environmental impact, such as carbon emissions and other forms of pollution, but it also rewards companies for adopting greener technology.

-

Social: This relates to how committed a company is to social causes, like inclusion and the elimination of workplace discrimination.

-

Governance: This relates to the company’s corporate culture, executive pay, and corruption.

While the companies we're investing in need to have the right financials to merit an investment, they also need to pass this test to ensure their growth doesn't mean our society's demise.

Again if you want to read more about the nuances of this strategy then just click here.

But if you're up to speed, let's get into the portfolio's performance and the newest updates!

Performance:

Let's just say we couldn't be more excited about this portfolio's performance. Up 7% since June, this portfolio is absolutely blowing the market out of the water!

So what drove our outperformance? 👇

Looking at the table we can see that our 3 largest drivers of success were due to GS, GILD, & GWW. While other parts of the portfolio also did well, these three names shined above the rest.

But while counting our wins is great, what's even more important is looking at what went wrong. And we see that ADBE, UDR, & BIO were the three largest detractors.

Specifically looking at Adobe ($ADBE), we see that its 10% weighting contributed to -1% of the performance of overall the portfolio. So what happened?

Outside of technology stocks getting crushed this year, Adobe's acquisition of Figma for $20B was received poorly by the market.

While Figma is a great company, Adobe was ultimately "forced" to buy this company -- and the price tag at which they did it was very troublesome for investors.

While we still like Adobe over the long run, paying this much for an acquisition is never looked upon favorably.

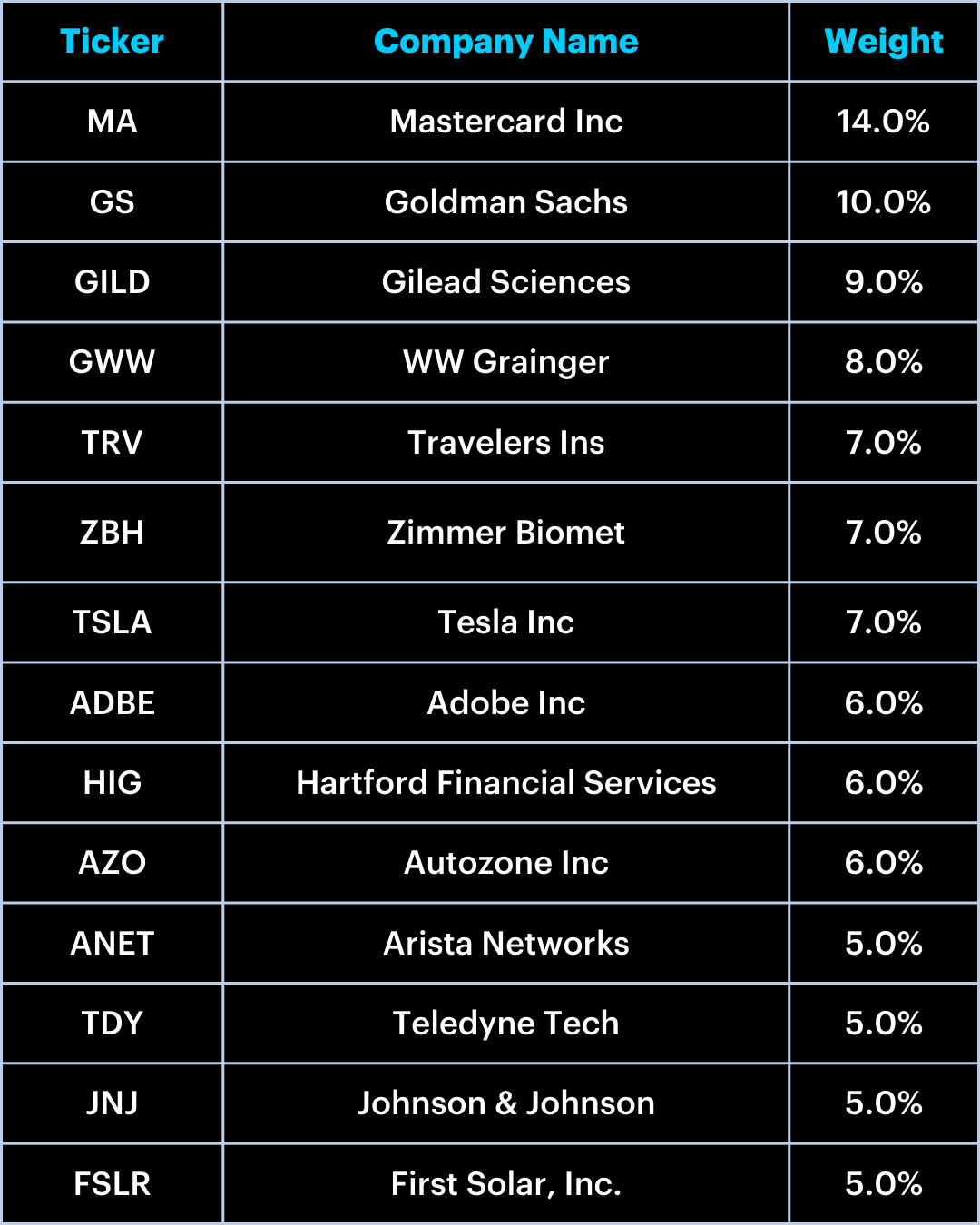

So, after further analyzing our winners & losers, and running them through our algorithm, we get the new portfolio 👇

New Portfolio:

The only changes (besides the weightings) in the portfolio this month was the addition of Tesla, First Solar, & Johnson & Johnson.

The only changes (besides the weightings) in the portfolio this month was the addition of Tesla, First Solar, & Johnson & Johnson.

While we won't dive into each name specifically, at a high-level TSLA & FSLR have obvious ESG benefits as they're directly contributing towards alternative energy solutions in order to keep climate change at bay.

In regards to JNJ, they're a champion of international health and should receive strong tailwinds from the increasing interest rate environment we're in.

Old Portfolio:

Changes:

Outside of the three additions discussed above, we removed JNPR, BIO, & UDR.

While we still like these names, the algorithm ultimately decided on removing these three stocks because we limit our total holdings and our relative strength.

We will continue to monitor these names in the meantime. If you have any questions on how this portfolio works, please just reach out!