The Flagship ESG Fund

Dec 20, 2022Almost two months later and it's finally time to update this portfolio for the last time in 2022.

And when we look back at the performance of this portfolio since it's inception, we're extremely excited to see that we've outperformed the index by 310%!

While there isn't going to be a ton of changes right now, we do want to make sure we're well-positioned going into the new year.

Therefore we're changing around some weights and adding in two new investments.

So with that context, let's get into the ESG portfolio updates 👇

ESG Overview:

But before we dive into our portfolio's updates, if you're new to this strategy then just click here for the original post or read the condensed version below.

If you already know about our ESG strategy, then just skip down to the section labeled, "Performance" below.

The goal of this strategy, however, is to invest in companies -- ethically. What does that mean?

Well, at a high level, ESG strategies help you invest in a way that reflects your values -- in a way that considers the impacts of the companies you invest in.

Therefore our ESG (Environmental, Social, and Governance) strategy is focused on investing in companies that are contributing to the positivity of the world as a whole.

In a nutshell, we're looking at three factors:

-

Environmental: This relates to a company’s negative environmental impacts, such as carbon emissions and other forms of pollution, but it also rewards companies for adopting greener technology.

-

Social: This relates to how committed a company is to social causes, like inclusion and the elimination of workplace discrimination.

-

Governance: This relates to the company’s corporate culture, executive pay, and corruption.

While the companies we're investing in need to have the right financials to merit an investment, they also need to pass this test to ensure their growth doesn't mean our society's demise.

Again if you want to read more about the nuances of this strategy then just click here.

But if you're up to speed, let's get into the portfolio's performance and the newest updates!

Performance:

Let's just say we couldn't be more excited about the portfolio's performance this year.

That's because our ESG portfolio is up 4.79% this period and 11.74% this year. Comparing that to the index, we see that it's down -.25% since the last period and only up 2.86% since its inception. That means our portfolio returned 310% better than the index or 8.88% on an absolute basis.

Long story short, this portfolio has not only been crushing, but it's also investing in responsible companies. Helping the world while also making money -- couldn't think of a better way to do it.

But what actually drove our outperformance? 👇

Looking at the table we can see that our 3 largest drivers of success were due to MA, GILD, and FSLR. While other parts of the portfolio also did well, these three names shined above the rest.

But while counting our wins is great, what's even more important is looking at what went wrong. And when looking at what went wrong, see that Tesla & Autozone were the two largest detractors.

Specifically looking at Tesla ($TSLA), we see that its 7% weighting contributed to -2.4% of the performance of overall the portfolio. So what happened?

Outside of technology stocks getting crushed this year, Tesla is taking on additional heat via the drama with Elon + other macro factors.

If you want to see our full analysis on Tesla, just click here.

But the TL;DR version is that EV stocks in general have seen a lot of headwinds this year. But we believe in 2023, while those headwinds may persist, Tesla's gap relative to its competition is just going to continue to widen. While the stock got crushed this year, we still love it in the long run.

Past Tesla, Autozone was the only other negative name in our portfolio. While its contribution towards our performance was relatively negligible, if we're being perfectionists, it still didn't perform up to par.

So what happened? Well similar to Tesla, the auto industry has seen a lot of headwinds this year. Pair that with a slowdown in retail demand, and Autozone had a bad month stretch. However, it's still up strongly on the year and we believe it'll continue to outperform over the long run!

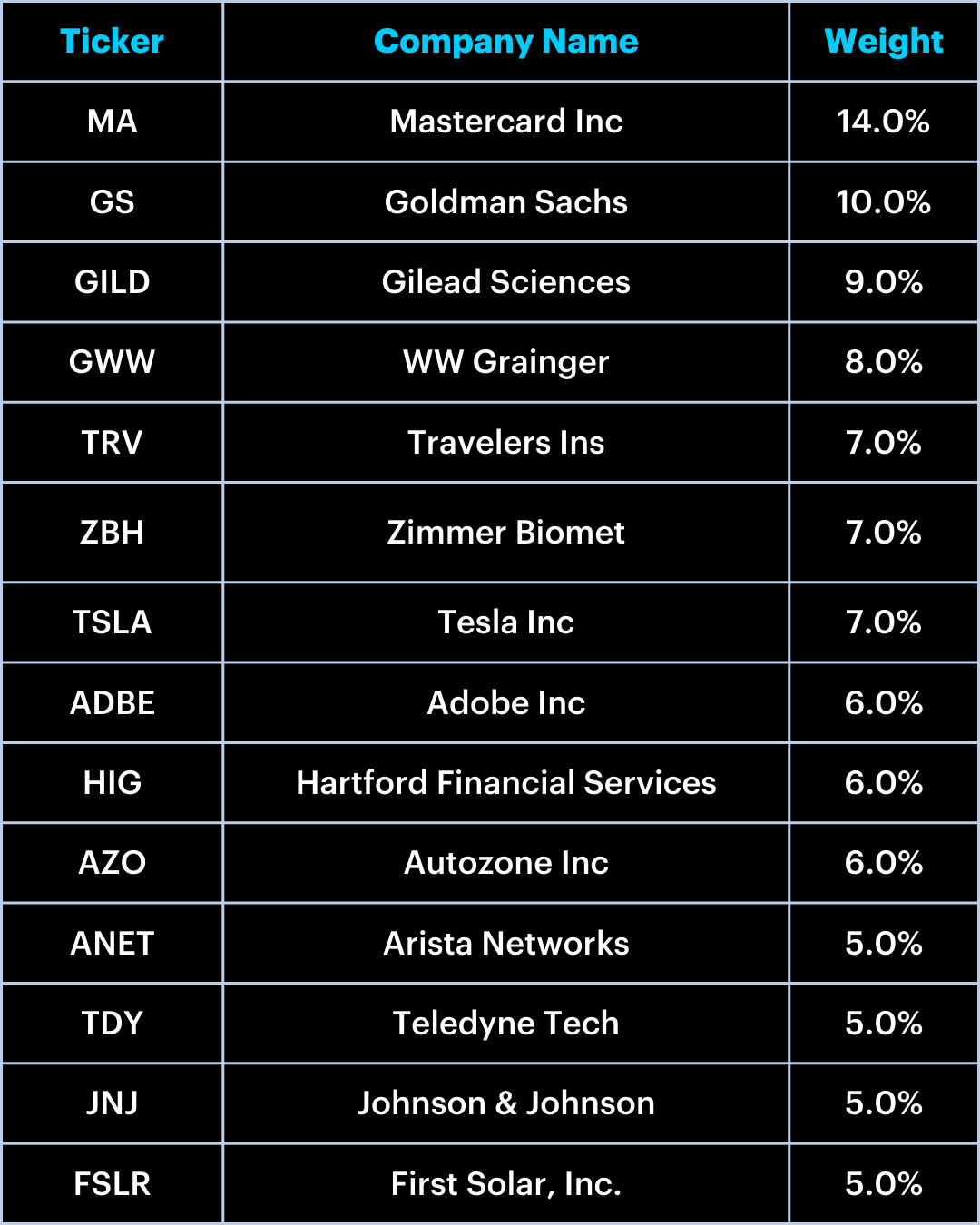

So, after further analyzing our winners & losers, and running them through our algorithm, we get the new portfolio 👇

New Portfolio:

The only changes (besides the weightings) in the portfolio this month were the additions of AbbVie & Apple.

While we won't dive into the ESG specifics of the new stocks, if you want to see their full contribution -- just check out Abbvie earnings & Apple earnings.

The reports are extremely detailed and dive into the specifics of how they're improving society and the world around us!

Old Portfolio: