This Stock Just Crushed Earnings

Feb 02, 2023Price Target: $80 (18% upside)

Current Price: $68

Target Date: Q4 2023

Stock: e.l.f. Beauty ($ELF)

We've been pleasantly surprised by this latest slate of earnings season.

This is very much the quarter of winners and losers. Good companies are surviving and defining new market conditions while weaker brands are getting absolutely devoured from within by rising costs.

What's really awesome about this is that some of our old winners just keep winning even harder.

Brands like our beauty stand-by e.l.f. Beauty ($ELF) just keeps cruising to a dominant position in their vertical, hitting our second price target in a row on the way -- increasing by 128%!

ELF keeps nailing its original thesis while securing solid pivots.

Meanwhile, they're securing price increases that are making them dominant even in an inflationary environment. In yesterday's earnings call, we saw an astounding earnings and margin beat that is setting the brand up for a breakout in 2023.

Their retail prowess is expanding to several new stores, their digital and marketing efforts keep accelerating, and their margins keep on improving.

ELF is hitting an acceleration point that we really like to see and it's exciting to imagine how far they can push this momentum.

There's a lot to hype up here, so let's roll with the details 👇

e.l.f. Update:

We've been covering e.l.f. for the better part of a year now (read our most recent analysis here).

The brand has spent 2022 on an absolute tear, capitalizing on a rapidly shifting beauty landscape and the relative weakness of its peers.

ELF has been on fire by locking in a digital growth strategy that has massively increased its margins.

ELF is marketed more as a mid-tier brand with luxury-level products. Their price point significantly undercuts the market without large sacrifices to quality.

Because of this, e.l.f. was the beauty brand of the moment as inflation heated up big time in 2022.

What we saw in the earnings call before yesterday was a brand that managed to survive price increases on its own end. e.l.f. increased the price of several products in H2 2022 to keep up with inflation and the results did not hurt margins.

ELF can afford to keep up with the cost of inflation while still coming in at a significant discount to more luxury-branded peers. This is a rare case where luxury branding does not help some companies outside of the top 1% cohort.

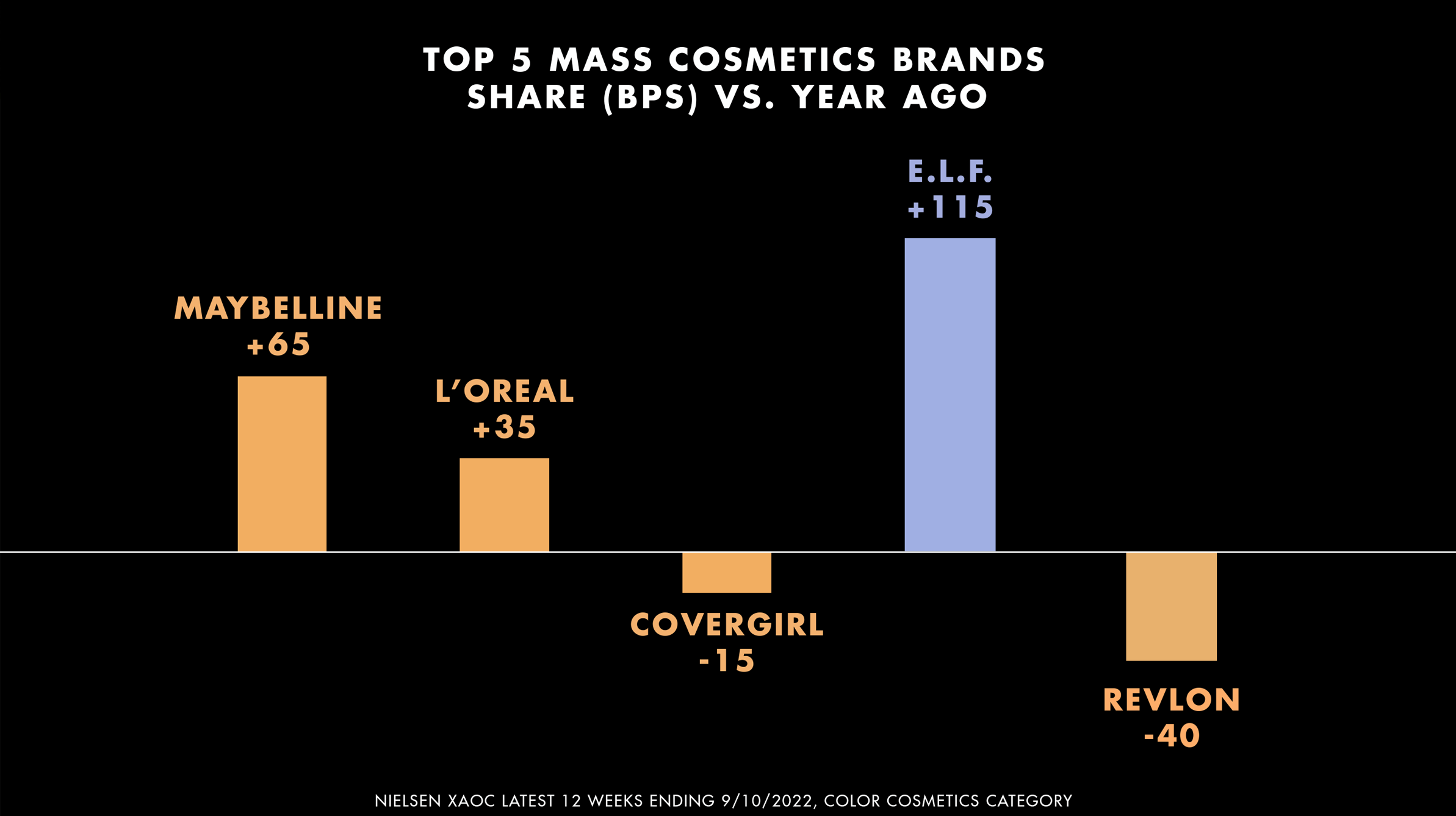

As a result, we are in a situation where e.l.f. is absolutely inhaling market share from peer companies.

Like we said with our review of Monster Energy yesterday, the entire first half of 2023 is going to be about who can keep up with inflation and who loses.

ELF has established itself as a standout winner in beauty.

What's really encouraging about that is ELF's hybrid model. ELF continues to win in its retail spaces and reduce logistical costs by utilizing its store model as individual warehouses in strategic areas.

A lot of that margin growth has come from expanded digital penetration, which also resulted in REDUCED SG&A expenses.

Every single dollar is working just a little bit harder as e.l.f. doubles down on its niche audience and cutting-edge social strategy that relies on massive Tiktok and BeReal audiences.

Sidenote: this is one of the first few cases we've seen of BeReal being a successful impressions channel for a brand. So props to them. We're unsure how the wider market can utilize BeReal, but it remains on the radar of our analyst team as that ecosystem develops.

But as e.l.f. continues to gobble up market share, the big question of 2023 will be how can they accelerate their gains.

The Big Expansions:

And the answer there is simple: e.l.f. will be rolling out with major retail partnerships moving into 2023:

2023 is going to be absolutely MASSIVE for e.l.f. as they double down on their nascent brand recognition by stepping up to the big leagues of major retailers. After some success with CVS, e.l.f. is hitting Walmart and Target shelves in a strategic rollout across H1 of 2023.

This will expand revenue, surely, but comes with a little bit of a margin hit.

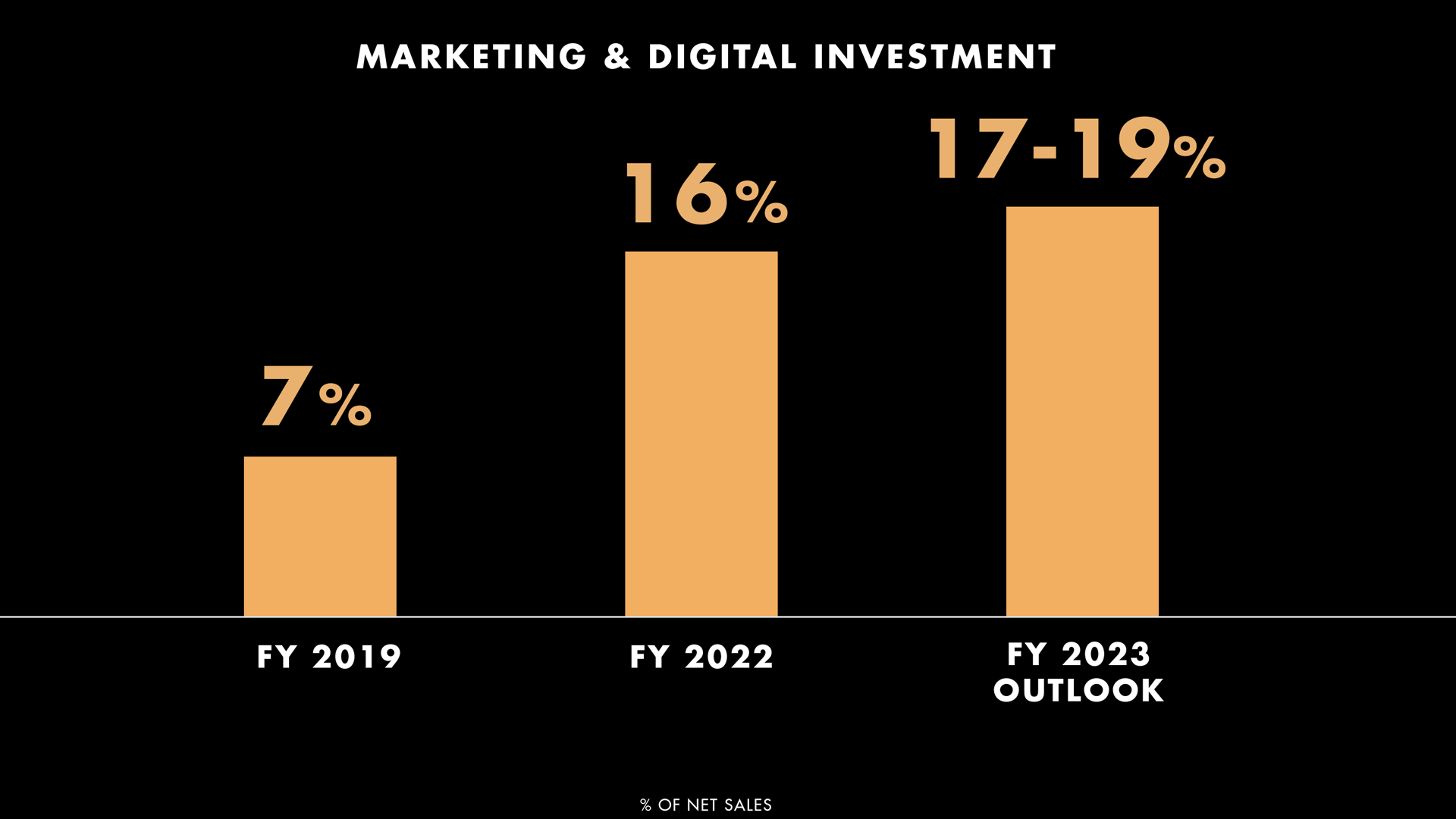

With how margins expanded last quarter--we're not super worried about that. One really interesting wrinkle to the Tiktok era of digital marketing is that strategic spending can be effective both at increasing margins and increasing overall impressions.

In the Facebook era, marketers had to prioritize either brand recognition or actually making money (hence the proliferation of niche DTC brands that focused on the latter).

In this new era of mass media where platforms like Tiktok power massive virality -- even strategic marketing spending and mid-tier influencer marketing can massively increase brand recognition.

This is going to pair nicely with ELF's rapidly expanding digital budget:

This is one of the things we like the most about e.l.f. -- it's not about expanding your footprint and margins, it's about doing things in the right order so you establish an entire ecosystem that feeds back into itself. 2023 is all about e.l.f. stepping into the big leagues and cracking into the top 3 of overall beauty brands.

e.l.f. Outlook:

Honestly, the wildest thing about e.l.f. is that all this growth is coming at a moment when the brand is still relatively undervalued to its peers.

ELF is trading at 21x revenue while peer companies are in the 22-23 range.

It's a small difference, but enough to make us feel like there's still some undervaluing happening here as ELF gets more and more market share.

Furthermore, e.l.f. is holding onto a solid $81M block of inventory--a much smaller drag on free cash flow than other retailers still languishing in billion-dollar supply chain gluts.

All-in-all, this is a brilliant brand that is simply executing well on a brilliant strategy. 2022 was ELF's year, but 2023 will very much be the start of their decade of dominance.

Rating: Overweight

Market Cap: $3.6B

Dividend Yield: N/A

Risk/Reward: Medium / Medium