Disney: How They Can Win the Streaming Wars

Feb 16, 2023Price Target: Unlock

Target Date: Unlock

Stock: Disney ($DIS)

Streaming and media in general have been in a rough patch for the past two years after a huge wave of competition came after the empire Netflix built.

For a while there, it was like every single media-adjacent property was launching cheap streaming services.

Services like CNN+ launched and flared out instantly while established firms like Disney got hammered with competition and rising costs.

This was maybe the worst possible moment for the streaming wars to peak, as Disney was in the midst of a huge reorganization after legendary CEO Bob Iger stepped down to let Bob Chapek take charge.

What followed was a mix of bad timing and worse management -- as Chapek's reorganization strategy only really lead to a massive ballooning of costs at Disney that has slowly eroded the value of the company by a factor of nearly 50% since its peak.

However, this year Bob Iger returned as Disney CEO and breathed life back into the company when he delivered his first earnings call last week.

Iger has announced a lot of changes that give us confidence that Disney can get back on the right track, even with the future of streaming as an industry looking pretty murky.

This, combined with the solid growth of Parks revenue, is enough for us to initiate a bullish position in Disney stock!

Disney has a long way to go before they're back to its dominant position, but of all the media plays out there right now, Disney is the one we're going to ride with long term.

Creators are back in control at Disney and their brand has a diverse range of revenue sources they can rely on to get media back to strength.

We've got a lot of details to cover, so let's just get into it 👇

Disney Parks are Back on Track:

Disney has always been a winning move in the streaming era because they have multiple paths to revenue.

The reason we continue to be skeptical about Netflix is simple: they only have one product and their revenue is entirely dependent on nailing a massive viral hit every few months.

Meanwhile, Disney has its parks and other experiences that build "flywheel effects" off of the success of its media brands.

Well, except for the past 3 years with COVID and inflation wreaking havoc on hospitality and travel.

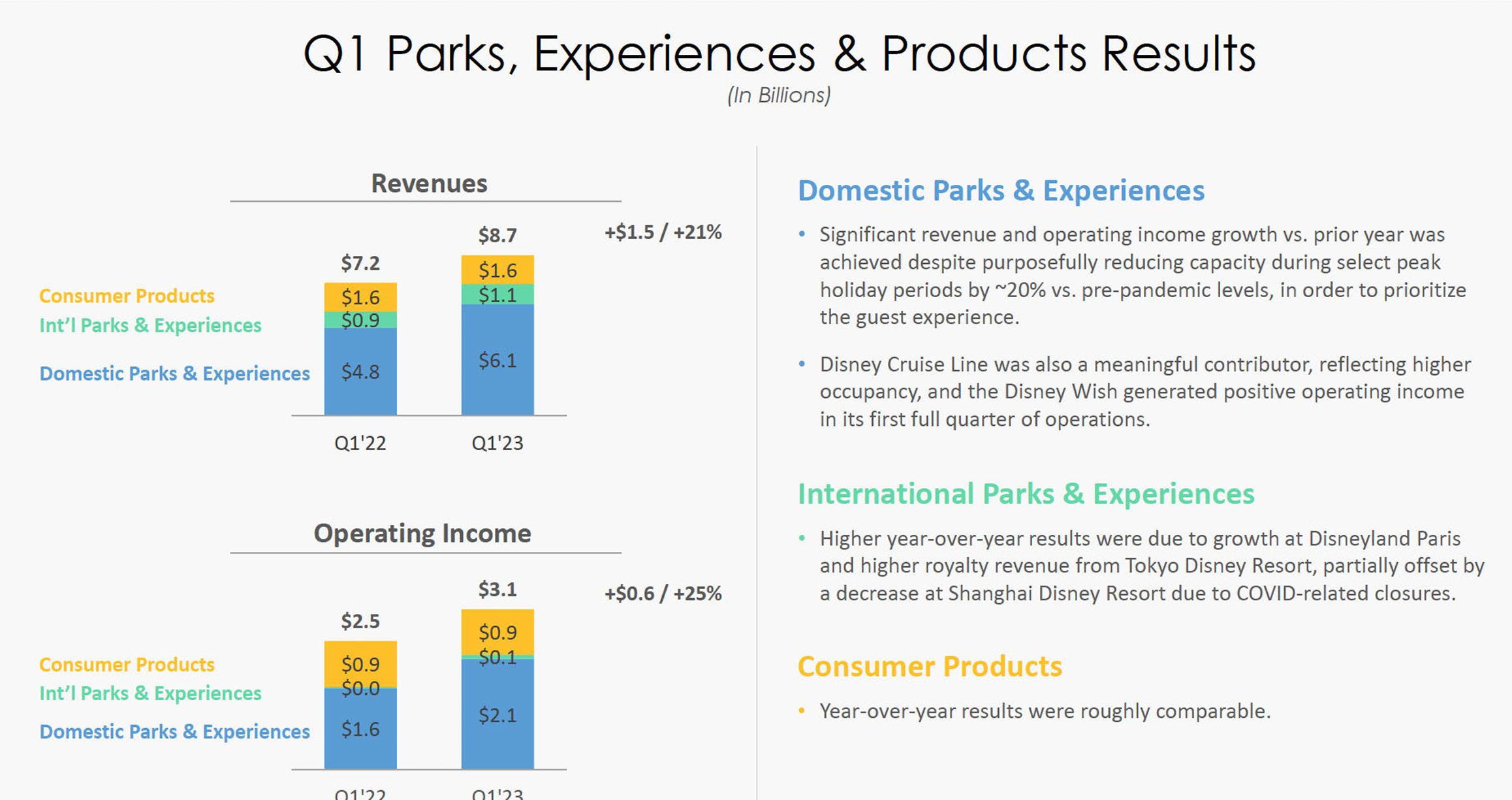

It's been a rough go for Disney's parks division, but last week's earnings call demonstrated that things are finally back on the growth trajectory:

We like that Disney is being smart about getting back to capacity instead of just relying on waiting for the pandemic to end.

While there are encouraging signs that we're approaching an end to the wider COVID pandemic, there's still a lot of risk of new variants sending us right back to a more defensive strategy.

Disney is strategically managing capacity during peak periods in order to prioritize the guest experience.

Rather than hurt revenue, this has paid dividends, as the US parks business experienced a staggering 35% margin in this quarter.

That's insane for a parks business and our analyst team has never seen anything like it.

These revenues are great right now because they put Disney ahead for the year when their weakest revenue period (Q2) is still ahead of them.

That way, a small slowdown in Q2 won't hurt as much as it could since Disney is still on-pace for the year.

Furthermore, we're really encouraged by this revenue increase coming across the board. US parks were the primary driver, but cruises and international parks also did a fair bit of heavy lifting as well.

The reopening of Disney parks in Paris and Shanghai was a huge boon on this end too.

With more and more consumers getting confident about vacations and Disney getting pitch-perfect in its management of their experiences branch, we're confident that the worst of the early 2020s is behind Disney's parks business -- especially with the reorganization we see hitting their media empire.

How Disney Can Save Streaming:

Disney+ was another bright spot in last week's earnings call as their subscriber count there is finally gaining at a positive rate.

Furthermore. Bob Iger committed to getting Disney+ to profitability by the end of next year.

That's no small feat but streaming absolutely churns through cash. And it's been especially bad at Disney during the Chapek years.

But hey, Bob Iger's return means we're getting costs back on track:

The way Disney's 2020 leadership reorganized their business seemed like a solid, streamlining move at the time.

All content and financial decisions would roll through a centralized Disney office instead of being in the hands of the individual studios that Disney has brought under their larger umbrella.

This could have worked in terms of producing network effects. But all this really accomplished was massively ballooning Disney's costs at the worst possible time.

So Bob Iger is bringing back the old-school methodology here.

Disney is putting creative and financial control back in the hands of their subsidiary studios and Disney is cutting 7,000 roles across the board (mostly from that centralized content arm).

The key here is that's excluding sports.

Disney has a solid brand in the form of ESPN and is largely leaving that alone as things reorganize.

Again, the goal here is to get Disney+ to profitability by the end of 2024. Cost cutting is one way of doing it, but the other is making sure that studios have the control they need to execute the way Marvel did before 2019.

With that said, the big question moving forward for Disney is Hulu.

Bob Iger has basically hinted at the possibility of a sale of Disney's stake in Hulu -- which may help their content streamlining efforts. But there are a lot more details to be worked out there.

Regardless, this new focus on content is an exciting departure for Disney and we're eager to see how they develop toward their Disney+ subscriber goals.

Disney Outlook:

With Iger at the helm for at least the next two years and a focus on content and profitability, we really like what we see at Disney right now.

We don't anticipate them maintaining their ludicrous margins in parks but we're eager to see how they can keep revenue moving even through their off months.

Content is a slow business though, so we're going to check back more in Q3 to see how realigning has worked for them and how their focus on content is doing.

Regardless, we see this as the end of the downturn for Disney and the beginning of a new era as they build dominance in a goofy streaming industry.

Rating: Overweight

Market Cap: $196B

Dividend Yield: N/A

Risk/Reward: High / High