Why Dick's Sporting Goods is up 40%

Mar 09, 2023Price Target: $184 (26% upside)

Current Price: $146

Target Date: Q1 2024

Stock: Dick's Sporting Goods ($DKS)

If you stopped by the analyst desk back in December and told us that a retailer would be one of the first stocks to hit our price target in 2023--we probably would have laughed you out of the room.

But surprise--even though we made a pretty aggressive bet on Dick's Sporting Goods ($DKS) and their finely-tuned omnichannel strategy, they absolutely smashed through our price target during their earnings call yesterday.

Of all the retailers we have covered--Dick's has put together the best strategy for handling the inventory woes plaguing all retailers in this weird supply chain/ COVID limbo.

And they have the numbers to back that up. Same-store sales have skyrocketed as DKS incrementally consolidates what is probably the best omnichannel strategy in specialty retail.

Honestly, this article is going to be a rehash of our last one (just go ahead and read that here) but with way niftier numbers. So let's go ahead and make this one quick.

When you go omnichannel--it's hard to go back. Let's get some quick details 👇

Omnichannel Wins So Hard:

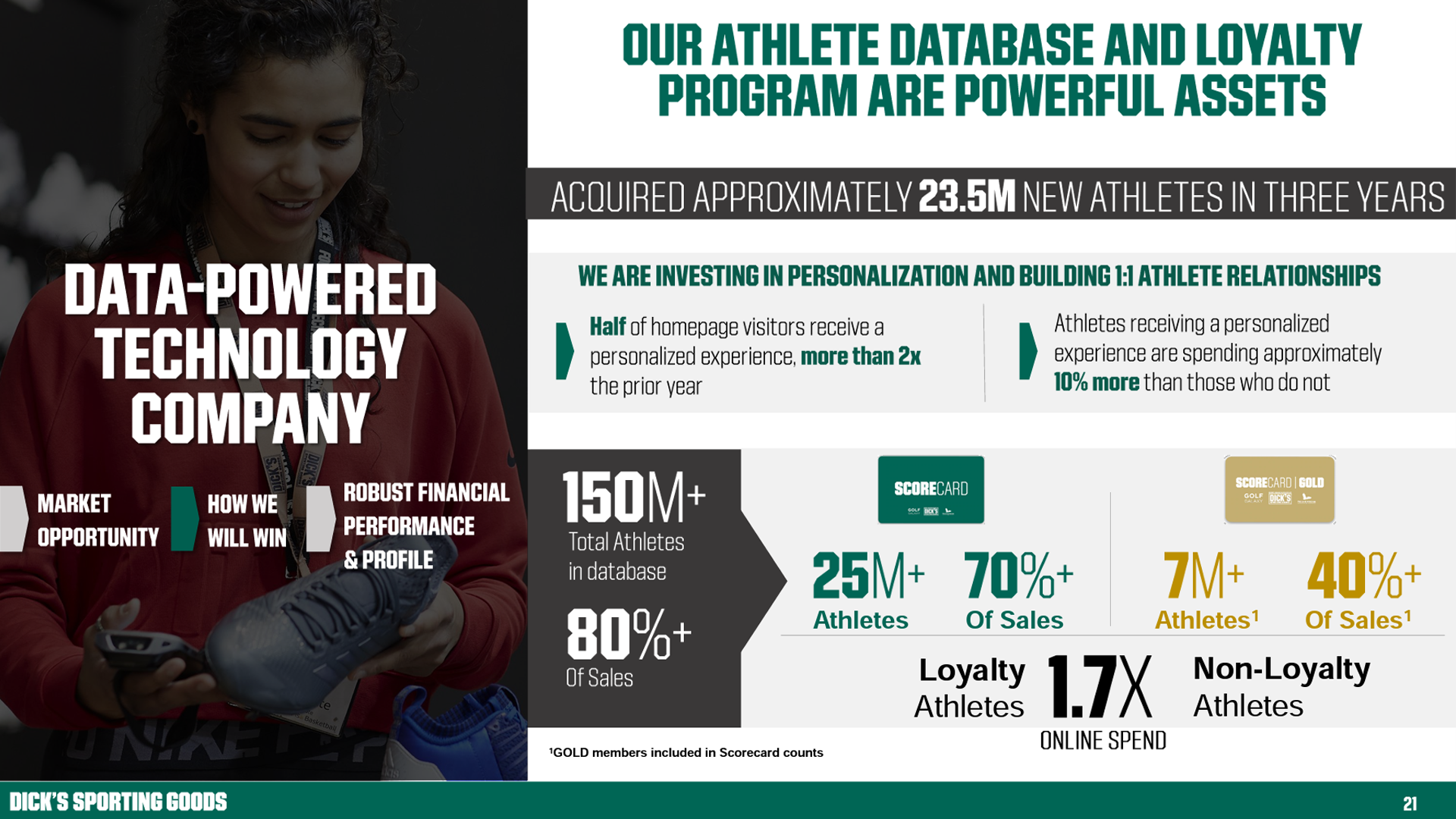

This entire retail game is all about selling as much as possible as cheaply as possible. Dick's has locked in Omnichannel as their path to winning that game. When we say Omnichannel--we simply mean that Dicks has a way to get as many people to their stores as possible and then use those stores as a hub for their online sales as well.

Not only does this demolish costs--using stores as localized warehouses to save money, but it also makes things way more convenient for high-value customers being developed by DKS.

This plays into another area of development for DKS--they are unifying coverage of sports across the country and getting serious non-professional athletes to stick around their stores to serve basically all their needs:

DKS has primed itself to create extremely high-margin customers utilizing this loyalty and omnichannel strategy. These two tiers have combined together to help the brand hit the highest margins it's seen since pre-COVID times. In a lot of ways--DKS has completely recovered from COVID and its subsequent inflation apocalypse--causing the stock to absolutely pop off.

But all of that would be pointless unless they could solve their industry-wide inventory issues.

Sorting That Inventory:

Honestly, this section just needs one fact: In the first half of 2022, the spread between inventory growth and sales growth was over 50%. Now? It's 16%. Dick's still has a bit of an inventory problem, but they've cut that issue by over 60%. Compare that to brands who are still accelerating their inventory woes, and you'll see why Dick's is being compared so favorably.

And it feels almost like an unfair advantage for DKS right now--their inventory is cyclical in nature and therefore they just have an easier time liquidating old inventory (especially with their growing Going Going Gone brand of liquidation warehouses.)

Turning the inventory apocalypse into an advantage is just an outlandish win for DKS, and we believe management when they say they'll have inventory growth completely under control by the end of the year.

Dick's Outlook:

2023 is going to be all about winners and losers. While general retailers like Walmart and Target continue to languish under the weight of their inventory--specialty stores like Dick's have a strong opportunity to consolidate growth and catalyze really strong optimizations. Dicks needs to keep expanding their e-commerce footprint and maintain the solid wins they've had in footwear, team apparel and golf.

If you win this much when the market and economy are this hostile--we really can't wait to see what they'll do as things continue to improve.

We're really excited to see where they take things from here

Rating: Overweight

Market Cap: $12.15B

P/E Ratio: 12x

Dividend Yield: 1.69%

Risk/Reward: Medium/Medium