Can This Stock Win 2023?

Dec 08, 2022Price Target: $141 (23% upside)

Current Price: $115

Target Date: Q1 2024

Stock: Dick's Sporting Goods ($DKS)

As we round through the end of Q4 and the potential of a small Santa Rally (if inflation behaves) we're going to be picking a few of our top retailers who have shown strength through a particularly tough time in the American economy.

We've been harping on the troubles all retailers are dealing with for a while now, so let's double click into one that has been a really heavy weight on the likes of Target: overflowing inventory.

With all the supply chain issues of the past two years, retailers responded by massively over-ordering inventory to keep up with consumer demand even if the economy gets completely disrupted again.

All of this inventory hit American shores at the same time that consumer demand started to waver under the weight of inflation. This hammered retail stocks and hurt revenue.

But some companies have managed to turn this into a pretty solid win all around.

Particularly, Dick's Sporting Good's ($DKS) has done a brilliant job managing its glut of inventory without sinking too much capital into it -- structuring all its expectations around using its bulked-up stockroom to fuel holiday deals.

The strategy seems to be working so far (but we won't get granular data until Q1's earning season hits.)

Furthermore, this brilliant inventory management, combined with strong e-commerce performance, has set Dick's apart from a lot of retail. DKS is set for a strong 2024 and is ready to prove they are far more than a pandemic winner.

There's a lot more to cover on why this stock can deliver strong returns, so let's get into it 👇

Dick's Overview:

Dick's was a fairly average sports retailer getting absolutely brutalized by Amazon for the longest time. Then COVID-19 hit and every consumer in America decided they needed to build their own home gym--causing DKS stock to skyrocket 7x to $141/ share at the peak of bull run mania back in September of 2021.

Since then, DKS has gotten cut by 50% to $70/ share during the depths of inflation-depression back in June. Now, the company is finally leveling out and finding long-term reasons to be optimistic.

Basically, Dick's handled both the pandemic and the supply chain crisis that followed brilliantly. They shifted hard into e-commerce, delivered growth for their internal brands, and used their stores as omnichannel warehouses to ensure lots of options for getting the right discounts to the right consumers at the right time.

All of that realignment lead to a historic beat on profit last quarter:

After a tough year in 2021, Dick's has put everything together to ensure that every dollar they put into the business is doing more than double the amount of work it was last year.

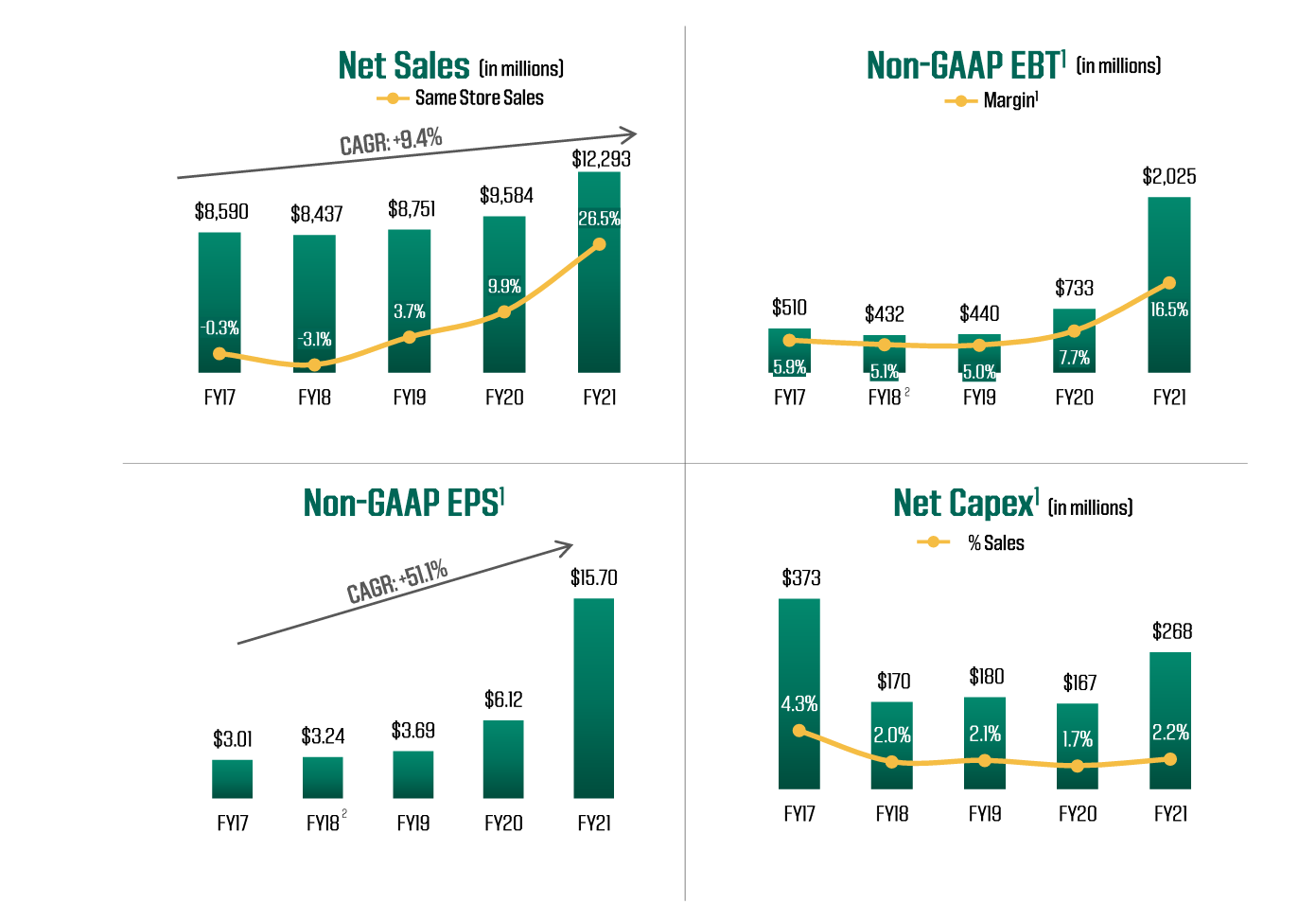

And this has led to 900 bps of gross margin expansion over the last few years! That alone is enough for us, but let's check into how they've put it together.

Dick's is Showing Strength in E-Commerce:

A lot of the strength in DKS right now is coming from e-commerce sales.

Of the $12 Billion in sales Dick's pulled off in the last fiscal year, $2.6 Billion came from pureplay e-commerce sales.

This is driven by a solid website experience that the team is seamlessly integrating with in-store shopping.

Dick's is able to win on shipping costs by using its retail locations as distribution centers -- keeping costs down and shipping times low.

A strong push for curbside delivery and in-store pickup has driven a bunch of new businesses to Dick's new pureplay e-commerce site.

These days, e-commerce is all about the small details.

Dick's is constantly testing and iterating its website and app to squeeze as much value as possible out of every individual customer.

That's why we love seeing the same-store sales figure in the chart above as well. Same-store sales have spiked 26% in the last year.

We see this as a solid explanation for DKS's spike in profitability.

Not only is Dick's keeping costs under control, they are getting folks to shop more and more in their local stores, extracting a huge amount of value out of all of their promotional efforts.

All these small details combine to make DKS a force to be reckoned with moving forward as the macro environment improves.

Dick's Outlook:

Our only real concern with Dick's stock right now is that this 10% increase in the last few months may be more to a shorts squeeze than bull sentiment from the market.

We've been waiting for the stock to come down a little more -- but the company has stayed pretty solid around the $115 range. Therefore, we've waited long enough and are excited to initiate coverage in this surprising new winner in retail and e-commerce.

Their growth will come at the expense of weaker nationwide retailers -- but at the very least we're excited that retail is looking capable of producing winners again.

We're excited to see them continue completely own youth sports--giving them a huge edge with a growing consumer base.

Rating: Overweight

Market Cap: $9.62B

P/E Ratio: 10x

Dividend Yield: 1.69%

Risk/Reward: Medium/Medium