Where Will CrowdStrike Be in 3 Years?

Sep 28, 2022Amongst the selloffs that are continuing in Big Tech, the analysts at Moby.co are excited by the gains we've seen in cybersecurity firms like our standout Palo Alto Networks (PANW) position. Why would this be happening when budgets are shrinking so drastically?

The truth is pretty simple: while other SaaS companies are buckling under reduced IT budgets -- security plays are seeing more budget flow their way as we emerge into a new era of hacks and security pains.

This is why we are excited to add to our cybersecurity portfolio today by initiating a position in Crowdstrike ($CRWD).

Rather than taking away from our position in Palo Alto Networks, Crowdstrike is carving out its own highly competitive niche that allows them to grow well during this period of downturn thanks to a rapid expansion of efforts to secure businesses against the growing cyber war:

Crowdstrike is using a solid combination of expanding business lines from M&A and partnerships to be a contender in the cybersecurity space for years to come.

There are a lot of details to cover, so let's get into it. 👇

CrowdStrike ($CRWD Overview):

Crowdstrike has been a cyber security powerhouse for just over a decade and has grown well since its strong IPO in 2019.

We're not going to waste too much time with the full cyber security overview -- as our thesis on cybersecurity firms hasn't changed since our recent update about Palo Alto Networks (check that here).

Crowdstrike offers mid-tier and enterprise services for cyber security and is zeroing in on data management, identity, and cloud security as its main focuses.

This allows them to slip into space that rivals don't cover as well and be a specialist solution without starting too much of a bloodbath with competitors.

CRWD has some exciting strengths compared to Palo Alto Networks though.

They have genuinely insane customer retention and a proven track record of 5-10x'ing the business lines of their various M&A plays. Let's double-click into those two as they form the crux of our position.

Insane Retention:

Retention is everything in SaaS. At Moby.co, we're able to take a longer view and do more detailed analysis because members like you stick with us for the long term (thanks for that by the way -- you have no idea how much we've been able to build thanks to your incredible support).

Most SaaS businesses have a little trouble with retention and have to devote resources to a team comparable to their sales team.

This brings us to the number that basically inspired this report:

Crowdstrike has never gone below 97% customer retention since they started reporting numbers in 2018.

It's really hard to wrap your head around how big that number is. A good benchmark for quarterly retention is in the 80% range.

97% just blows that out of the water. This allows CRWD to focus on sales and expanding its product rather than chasing revenue they've already secured.

This level of retention demonstrates how necessary the market views their product and allows them to chase those glorious SaaS earnings multiples even in a bear market.

More importantly, it allows them free reign to pull on other inorganic levers (like M&A) and expand rapidly out of those business lines.

Identity is the New Silver Bullet:

Frankly, being consistent and maintaining growth in this economy is a huge win -- one of the first big M&A wins Crowdstrike pulled off post-IPO was their acquisition of Preempt in 2020.

Basically, Preempt helps companies lock down potential weaknesses in Identity Management. CRWD was able to 10x this business and then expand it into an ~$80mm ARR business line. Which is cool, but only the start of the story.

Maybe you heard about how the INSANE hack that nearly blew up Uber last month came from a single employee accidentally giving their credentials to a hacker. Maybe you've heard more and more about "Social Engineering" and how any company is only as strong as its most gullible employee.

All of that is true and identity is becoming the new holy grail in cybersecurity spend.

It's estimated that as many as 80% of all breaches are caused by credentials being managed poorly or getting stolen or being socially engineered into the hands of Estonian 14-year-olds.

Crowdstrike has managed to grow and develop Preempt into an Active Directory lockdown service. Without accidentally nerding-out too hard, CRWD basically has an advantage here over Okta by securing identity protection a little better and on a slightly stronger foundation.

This doesn't kill Okta in the long run, but it allows Identity protection to be the next business that CRWD can expand to ~$500mm ARR in the next several years. This is the line that turned our interest in Crowdstrike into pure bull sentiment.

TAM is Exploding:

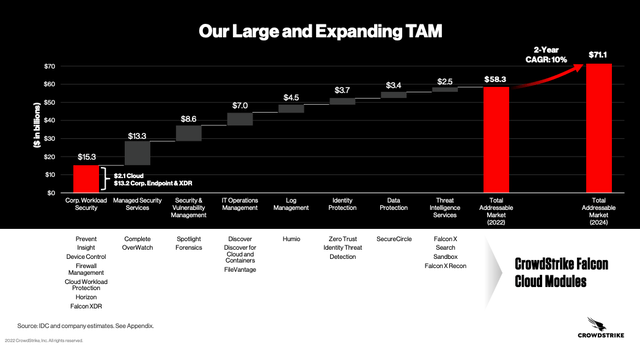

And just to hedge our bets, we're also excited to see how big CRWD's TAM is expanding according to their internal documents:

Crowdstrike's TAM has basically 5x'd in the past 5 years--and is set to increase another 50% by 2024 to ~$70 Billion. With a sales team unencumbered by customer retention and a product team with a proven record of supercharging businesses brought in via M&A -- we see a really bright future for the CRWD team even if there are short-term headwinds for the rest of the market.

Crowdstrike Outlook:

All of this combines to make us strong bulls on Crowdstrike without pulling back from the rest of our cybersecurity portfolio.

With cybersecurity being one of the only games in town right now, we're also anticipating more competitive pressure from new businesses & VC investment flooding the space. However, cybersecurity comes with enough moats to make Crowdstrike a business that you can only really slow down a little, not outcompete altogether.

CRWD's big moves in the next 2 years will be doubling the ARR from its Identity line and making bigger inroads for its SMB verticals.

Right now they have 35% market penetration for their core business, but only 1% for their TAM in the small business space. As that spend expands, it will become a goldmine for Crowdstrike and other providers.

We're really excited to see just how far they take this thing.

Price Target: $215 (30% upside)

Current Price: $165

Target Date: Q2 2023

Rating: Overweight

Risk/Reward: Medium/Medium

Dividend Yield: 0%

Market Cap: $39B